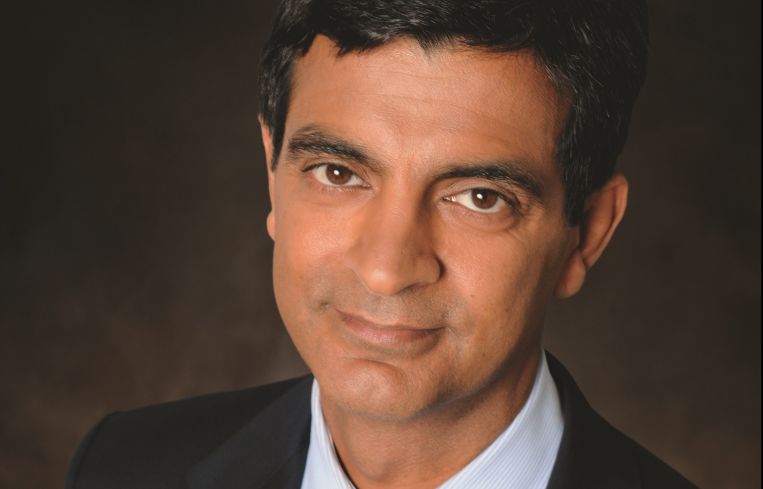

Updated: Sandeep Mathrani Departing From Brookfield

Sandeep Mathrani, the CEO of Brookfield Properties’ retail group by way of its 2018 acquisition of GGP, is leaving his position at Brookfield.

Mathrani sent an email to a number of friends and colleagues in the business this week saying, “My time has come to embark the train to the next stop,” according to a source who received the email.

The email did not say why Mathrani was leaving his position as vice chairman and chief executive officer of Brookfield’s retail division, or who’s decision it was, but Bloomberg reported last month that a memo had gone out about his pending departure, effective Jan. 31.

“Following our acquisition of GGP last year, Sandeep has helped ensure a seamless integration of the business into Brookfield Properties,” Brookfield’s CEO Brian Kingston said in the memo, as quoted by Bloomberg. “Now that transition is complete, it is the opportune time for him to pursue a new challenge.”

Neither Mathrani nor representatives from Brookfield returned requests for comment by press time, but the new head of retail will be Jared Chipaila, according to the memo.

The move comes less than two years after GGP, the country’s second largest mall owner, was acquired by Brookfield Property Partners in a $15 billion acquisition. Mathrani served as CEO at GGP.

“I have to believe it wasn’t for him,” said the source. “But Sandeep was always a bit of a cowboy … and it was a clash” with the more button-down culture at Brookfield. “My gut says that there are certain things that are not fits.”

Mathrani came to Chicago-based GGP from Vornado Realty Trust in 2010, when the mall REIT was still reeling from a bankruptcy declared the previous year at the height of the Great Recession.

By the time of Brookfield’s 2018 acquisition, GGP had a portfolio of 120 properties spanning some 123 million square feet.

According to Crain’s Chicago Business, Mathrani stood to receive as much as $189 million from Brookfield’s purchase of the company.

Update: This story was updated to include the fact that Bloomberg originally broke the news.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)