Mapping the Mezz: Landlords Find Junior Debt Opportunities All Over the Grid

By Cathy Cunningham and Matt Grossman August 7, 2019 9:00 am

reprints

The fierce competition on New York City’s lending fields isn’t just limited to banks, debt funds, life insurers and mortgage trusts anymore.

More and more often, some of New York City’s biggest owners have launched debt arms, compensating for a conspicuous lack of appealing opportunities in the realm of pure equity plays. And now they’re giving the usual suspects a run for their money.

Not all of those owner-lenders are brand new to the scene. Brookfield Asset Management has boasted a lending arm focused on subordinate debt — led by Andrea Balkan — since the early 2000s. Ditto for SL Green Realty Corp., whose efforts, led by David Schonbraun, date to around 2002. But, as their entries in the pages to follow demonstrate, they’ve reached new heights in the size and significance of the capital-stack plays they’ve sought and won in recent years.

That success, perhaps, has enticed some other eager owners to test the waters — or even to dive in headfirst. Silverstein Capital Partners, a Silverstein Properties lending subsidiary led by Michael May, came out of the gate strong late last year with a nearly $250 million mezzanine loan on JDS Developments’ 9 DeKalb Avenue — a new construction project slated to become Brooklyn’s tallest building in the next few years. Even major international landlords have developed a taste for mezzanine debt in New York City, as was the case when Samsung took on a $100 million mezzanine slice at 485 Lexington Avenue as part of a Goldman Sachs CMBS refi.

Skeptics have fretted that these mezz positions make it all too easy for developers-cum-lenders to swoop in and take over struggling properties — but the proliferation of mezz executions hints that borrowers value these junior lenders’ serious property-management smarts. In that sense, the incentives might be better aligned than cynics give them credit for.

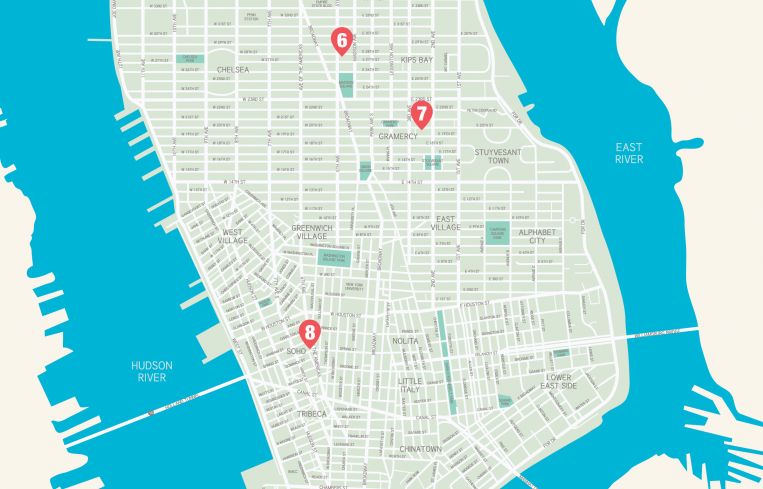

1. One Dag Hammarskjöld Plaza

In January, Brookfield Asset Management originated a $427 million whole loan on the tower, at 885 Second Avenue in Midtown, to help Rockpoint Group buy the 49-story office skyscraper in a $600 million acquisition. In an arrangement typical for Brookfield, the Canadian real estate giant then sold off a $365 million first mortgage to Wells Fargo, holding onto a $62 million mezzanine portion. The building, blocks from the United Nations Headquarters on First Avenue, hosts offices for the French, Spanish, Italian and Canadian U.N. missions, among those of many other countries. Memorial Sloan Kettering Cancer Center also leases several floors totaling more than 100,000 square feet in the quarter-million-square-foot tower built by developer Lawrence Ruben in the early 1970s.

2. 485 Lexington Avenue

The real estate investment arm of South Korea’s Samsung conglomerate is an impressive global landlord: Recent acquisitions have included a $238 million office tower in Denver, a $300 million apartment complex in Paris, a $350 million commercial property in London, and a nearly $600 million acquisition in Seoul. But to date, its New York presence has been exemplified by investments funneled through a mezzanine-debt initiative it launched in 2016. Two years ago, its $270 million mezzanine fund took on a $100 million mezz position in 485 Lexington Avenue, an SL Green-owned office tower between East 46th and East 47th Streets. The deal came about as part of a $450 million refi from Goldman Sachs in 2017; Goldman packaged the $350 million senior portion of the debt into a single-asset CMBS deal. Tenants include insurer Travelers Indemnity, law firm Phillips Nizer and offices for Xerox.

3. 350 Madison Avenue

Last autumn, a Midtown office refinancing gave Brookfield Asset Management another chance to strut its stuff: In a deal that refreshed the capital stack for 350 Madison Avenue, the company originated a $250 million whole loan for the sponsors, RFR Holding and the Qatar Investment Authority, while keeping a $50 million mezz loan on its books and offloading the $200 million senior portion to the New York State Teachers’ Retirement System, as per city property records. (Previous funding on the building had come in the form of a $156.4 million mortgage from Wells Fargo in 2015.) The building, between East 44th and East 45th Streets, offers nearly 400,000 square feet of office space on 25 stories. Its biggest tenant is another large New York City real estate lender: Bank Leumi, which leases 59,000 square feet, as per CoStar Group data. Other lessees include AlphaSights, The World Economic Forum and Alkeon Capital. Paul Stuart claims the retail frontage along Madison Avenue.

4. 229 West 43rd Street

Soon after Kushner Companies bought the six-story retail condominium in the lower portion of 229 West 43rd Street in 2015, it received a $370 million refinancing on the property. That deal was led by a $285 million first mortgage from Deutsche Bank, but it also included mezzanine debt from two New York City landlords: $70 million from Paramount Group and $15 million from SL Green. Kushner Cos. had high hopes for the building, an early-20th-century tower that once hosted The New York Times’ main offices, but several tenants have faced problems. A restaurant: Guy’s American Kitchen, closed; a planned Todd English-helmed food hall never opened its doors; and an interactive museum run by National Geographic was evicted earlier this year. A champagne bar intended for the property hasn’t moved in, and other tenants have won rent concessions. Recently, Kushner Cos. modified the terms of the mezz debt to bring it current after defaulting in March, as per CMBS watchlist notes.

5. 990 Avenue of the Americas

A January 2018 financing deal at this residential building, a looming 320-unit rental tower known as The Vogue, again exemplified Brookfield’s strategy in the mezz game: Originate a big whole loan, pass the senior debt to a willing taker, rinse, repeat. In this case, it initiated a $205 million whole loan, and then sold a $165 million portion to German real estate lender Deutsche Pfandbriefbank, property records show: Brookfield held onto a $40 million subordinate position for itself. The deal funded Vanbarton Group’s acquisition of the 25-story tower from the Karten family of developers, the first time the building changed hands since Isidore Karten oversaw its construction in 1987. The first four stories host office and retail tenants, and last summer, lawsuits mounted as the new ownership company, led by Richard Coles and Gary Tischler, tried to evict some of the building’s commercial tenants — presumably to lay the groundwork for a renovation.

6. 245 Park Avenue

A traditional image of real estate deals pits the borrower and lender on opposite sides of a negotiating table. But in a world of growing owner-driven mezzanine lending, the lines can often blur. When China’s HNA bought 245 Park Avenue, a 1.7-million-square-foot Midtown office tower, for $2.2 billion in 2017, it looked to SL Green for a $110 million mezzanine loan. But SL Green had also been interested as a potential buyer, SL Green Chief Investment Officer David Schonbraun told Commercial Observer in a 2018 interview: Indeed, its prior research on the deal is what allowed the company to quickly put a financing proposal together. Then, when HNA sounded a general retreat from New York City real estate last year, SL Green was ready to pounce, taking on an additional preferred equity position that secured it an ownership stake in the building after all. Tenants in the 48-story building, which towers above Grand Central Terminal, include Société Générale, Northwestern Mutual and the Major League Baseball commissioner’s office.

7. Gramercy Square

SL Green, a titanic office landlord, is also no slouch in the finance markets. At Gramercy Square, a joint residential conversion backed by Chetrit Group, Clipper Equity and Read Property Group, the real estate investment trust provided a $345 million whole loan in spring 2018 that included both senior and mezzanine financing. (The company hasn’t divulged the split.) The site, between East 19th and East 20th Streets, used to be Cabrini Medical Center, which closed in 2008. The development group is replacing it with a luxury residence that will include 223 condominiums in four separate buildings. Designed by Woods Bagot, the new construction will also include room for the private Gramercy Club, a fitness center, spa, and a lounge open only to building residents.

8. One Soho Square

Paramount apparently has a tapeworm when it comes to their appetite for mezzanine lending. In May, it signed on to originate $170 million in mezz debt on One Soho Square, a Downtown office building controlled by Stellar. Paramount’s debt accompanied a $730 million first mortgage from Goldman Sachs, which made the building the subject of a giant single-asset CMBS deal. CVS closed on a lease last October to rent the 13,000-square-foot retail space on the building’s ground floor, and other tenants include MAC, Glossier, Warby Parker, Aveda and Trader Joe’s. Stellar paid just $200 million for the property in 2012, which at the time consisted of two separate prewar structures. It combined them in an extensive renovation that added a joint lobby and took full ownership when it bought out its former partner, Rockpoint Group, in a $260 million deal in 2016.

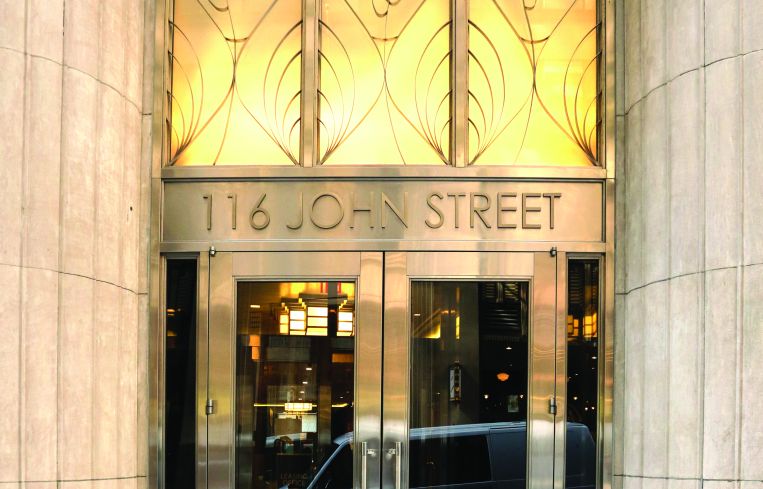

9. 116 John Street

When Metroloft, a major multifamily landlord in Lower Manhattan, went looking to refinance its 35-story Financial District property, 35 John Street, it turned to Brookfield for a $170 million whole loan. The senior debt — $130 million worth — went to AIG, while Brookfield retained $40 million in subordinate obligations. The loan helped add stability to an ambitious project: The august building was first built in 1931 as an office tower but received a second life when Metroloft took it over and converted it into residential use in a massive project that finished in 2012. Sandwiched onto a narrow, curving block between Pearl Street and Gold Street, the building is walking distance to the waterfronts of both the Hudson and East Rivers, a significant appeal that increasingly pulled more high-rent-paying denizens downtown in the last few decades. This summer, studio apartments smaller than 400 sqaure feet have rented for as much as $3,900 per month, a powerful sign of the building’s appeal.

10. 9 Dekalb Avenue

Silverstein Capital Partners burst onto the scene this spring as a major mezzanine lender with its $240 million junior financing on 9 Dekalb Avenue, an under-construction residential building in Downtown Brooklyn slated to become Brooklyn’s tallest tower when it’s finished in 2022. The loan on JDS Development’s project shares the capital stack with a $424 million senior loan from Otéra Capital. The Shop Architects-designed project will soar 1,066 feet and include both 150 condominiums and 425 rental apartments. The unique design avoids the demolition of a historic commercial building on the lot: a stone-and-steel structure that used to be home to Dime Savings Bank. Instead, the residential tower will rise above that landmark, which will be converted for retail use. The Silverstein and Otéra financing package replaced a prior $135 million mortgage from Bank OZK and Melody Finance that helped kick off the construction phase in 2017.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)