330 Madison Avenue Will Sell Within the Next Year: Sources

Could be a “new One Vanderbilt”

By Mack Burke June 11, 2019 5:17 pm

reprints

Abu Dhabi Investment Authority (ADIA), will sell 330 Madison Avenue within the year, sources told Commercial Observer.

Vornado Realty Trust announced yesterday that it will sell its 25 percent minority stake in the massive Midtown office tower, which is valued at around $900 million, and Bloomberg confirmed today that ADIA, which holds a 75 percent interest in the asset, has agreed to buy out the firm through one of its subsidiaries.

Vornado said in its press release yesterday that it expects the sale to close in the third quarter. A spokeswoman for Vornado did not provide a comment on the transaction.

But, ADIA won’t be sitting on its laurels. A source close to the property told CO that the investment giant—the world’s third largest sovereign wealth fund—“will sell the building within the next year.”

In January, The New York Post wrote that ADIA was looking to offload its interest for around $1 billion (and also indicated that Vornado was in line to hold onto its position). The Post said that CBRE (CBRE)’s Darcy Stacom and Bill Shanahan were marketing the sale of ADIA’s stake. But, Stacom told CO that ADIA had not, in fact, marketed the asset, but instead “went forward with the buy/sell [process] to gain control of 100 percent of the real estate.”

“ADIA wanted full control of the building,” Stacom explained. “We anticipate a positive reception, and being able to offer it fee-simple [will] be catnip to the investment community.

“It is one of the few 30 FAR Midtown East rezoning sites,” she added. “It’s nice to know that sometime in the future, if you wanted to create a new One Vanderbilt, you could.”

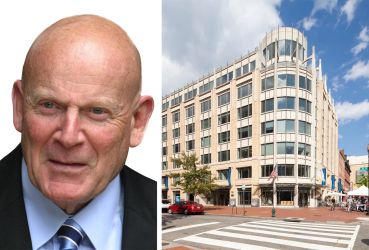

Built in 1965, the 40-story property between East 42nd and East 43rd Streets sits just a block from Grand Central Terminal and SL Green (SLG) Realty Corp.’s One Vanderbilt.

Major tenants in 330 Madison include HSBC, Guggenheim Partners and brokerage house JLL (JLL), according to Vornado’s website.

The 846,000-square-foot 330 Madison underwent a 121 million renovation and repositioning in 2014, according to a rating agency report on the MAD 2017-330M single-asset CMBS deal in which it was securitized. After the renovation, Vornado—in a joint venture with ADIA subsidiary Chadison—was able to execute over 600,000 square feet of new and renewal leases, according to a presale report from DBRS.

Vornado said it will pocketed roughly $100 million in its sale, after deducting the $500 million seven-year, interest-only loan provided by Wells Fargo in 2017 to refinance the building. At the time of the refinance, Vornado netted $85 million of the loan’s proceeds after it repaid a $150 million loan on the property that was provided by Landesbank Baden-Württemberg in July of 2015, according to property records.