Lower Manhattan Office Leasing Hits Seven-Year High: Report

By Nicholas Rizzi August 7, 2018 3:05 pm

reprints

Lower Manhattan had its strongest quarter of commercial leasing activity in seven years, with the technology, advertising, media and information (TAMI) sectors contributing to the bulk of the deals, according to a report from the Alliance for Downtown New York.

There was 1.9 million square feet of office space leased in Lower Manhattan—which the organization considers roughly from City Hall to Battery Park—in the second quarter of 2018, the greatest amount since the 2.5 million square feet snapped up in the second quarter of 2011 and more than double from the previous quarter and year-over year, the report indicates.

The Downtown Alliance attributed the strength of the second quarter to deals like J.Crew leasing 325,000 square feet for its corporate headquarters at 225 Liberty Street in March and McKinsey & Company’s 184,389-square-foot deal at 3 World Trade Center that same month.

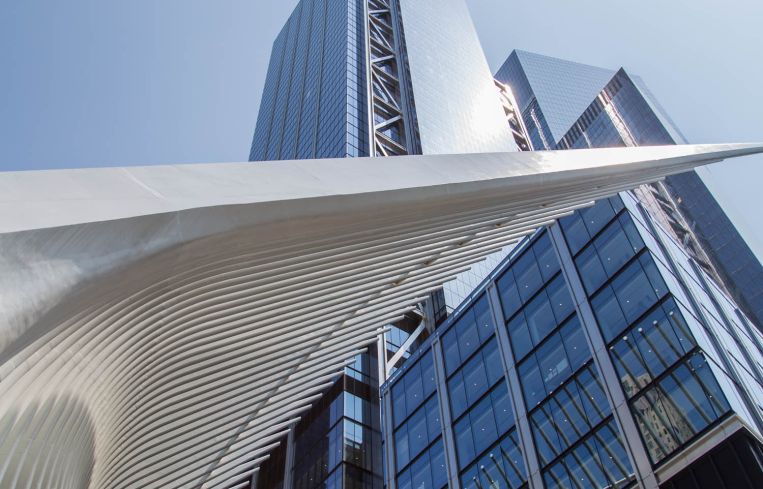

“The opening of 3 World Trade Center marked a major milestone for Lower Manhattan,” Downtown Alliance President Jessica Lappin said in a statement. “In addition to bringing new companies and jobs to the neighborhood, we’re thrilled to see the entire WTC campus opening up and integrating seamlessly into the local community.”

TAMI accounts for 36 percent of the leases signed in the neighborhood this year as of the second quarter, with information service company Wolters Kluwer leasing the third largest amount of space of any company—130,000 square feet at 28 Liberty Street. Finance, insurance and real estate (FIRE) sectors were right behind with 17.6 percent of the deals, as per the report.

Despite the strong leasing numbers, the vacancy rate shot up to 11.3 percent—the first time it climbed above 11 percent since 2014. The Downtown Alliance attributed that uptick to the opening of the 1.6-million-square-foot 3 World Trade Center in June. The building boosted the vacancy rate up 2.3 percentage points over the last quarter, and 2.4 percentage points year-over-year, but also brought up the average asking rents for Class-A office space to a record high of $62.90 per square foot, the report found.

Average Class-A office space increased from $62.30 in the first quarter and $61.70 from second-quarter 2017, according to the Downtown Alliance. Rents for Class-B office spaces fell slightly from the first quarter’s $55.20 to $54.90 in the second quarter, but was still up 3.9 percent year-over-year.