Stat of the Week: 18 Percent Increase

By Richard Persichetti June 22, 2016 9:45 am

reprints

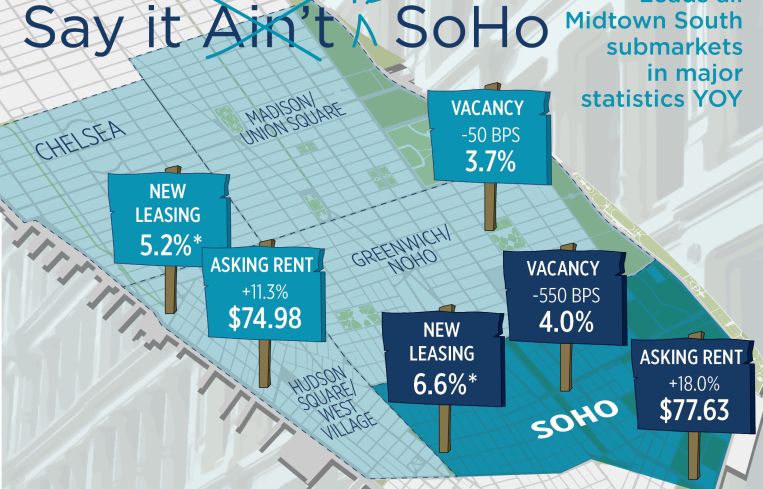

Demand remains strong in Midtown South, as it continues to outperform the rest of the Manhattan office market. Through May, Midtown South vacancy is down 40 basis points and stands at 6.2 percent, overall average asking rents are up 5.2 percent to $68.33 per square foot and new leasing activity is up 11 percent compared to one year ago. Soho leads all five of Midtown South’s submarkets in each category.

Vacancies are down in four of the five submarkets, led by a 550-basis-point decrease in Soho over the past year to 4 percent. Greenwich/Noho dropped 50 basis points during this time to 3.7 percent—the lowest vacancy rate of all 19 submarkets throughout Manhattan. The Hudson Square/West Village submarket had the only increase in vacancy over the past year—300 basis points to 8.8 percent—mostly due to two blocks of space greater than 100,000 square feet added to the submarket over the last six months.

Overall average asking rents are up year-over-year in all five submarkets, with Soho having the largest increase of 18 percent to $77.63 per square foot. Despite having the only increase in vacancy in the past year, the average asking rent in Hudson Square/West Village increased 11.3 percent to $74.98 per square foot.

New leasing activity totaled over 2.3 million square feet this year through May. The bulk of the activity was within Class B buildings that accounted for 36 percent, followed closely by Class C buildings at 35.6 percent. Despite six of the top 10 new leases signed this year being in Class A buildings, leasing in that class only accounted for 28.4 percent of the square footage signed. SoHo has the most leasing activity as a percentage of its total market size with 6.6 percent of the total supply leased this year. Greenwich/Noho has 5.2 percent of its inventory leased this year, while Madison/Union Square has almost 1.3 million square feet of new leases signed but only accounted for 4 percent of the submarket’s inventory.