LNR Grants Extension on $55M New Jersey Office Plaza Loan

By Danielle Balbi June 13, 2016 6:00 pm

reprints

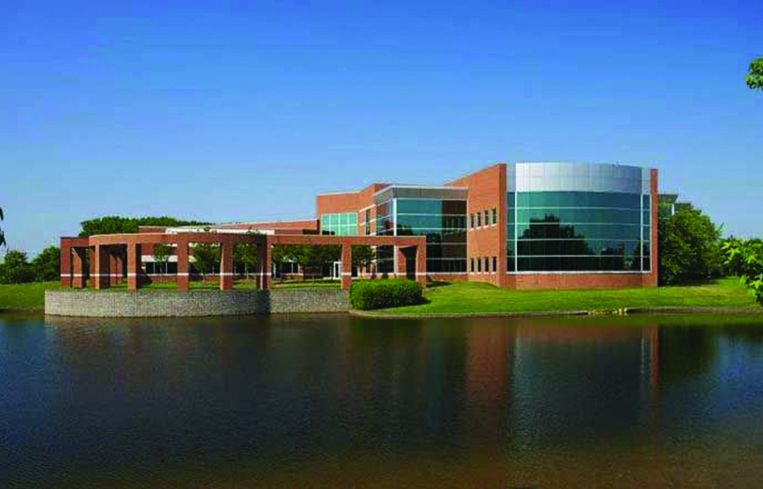

Iron Hound Management Company negotiated a three-year payment extension from special servicer LNR for a $55 million mortgage on three office buildings at 3, 6 and 8 Cedar Brook Plaza in Cranbury, N.J., Commercial Observer can first report.

The borrower, New Jersey-based Eastern Properties, went into maturity default on the property because of the loss of chemical company Rhodia, which occupied 90,000 square feet of the 339,428-square-foot collateral at Cedar Brook Corporate Plaza. The complex houses 10 other office buildings, but only three serve as collateral for the financing.

The loan’s new maturity date is in October 2018, and no debt reduction or bifurcation was arranged as a part of the restructuring, a source with intimate knowledge of the deal confirmed to CO.

The loan, which was securitized in Citigroup-sponsored CD 2005-CD2 with an original balance of $65 million, was transferred to special servicing in July 2015 because of imminent default. With Rhodia ending its lease in December 2015, Eastern Properties was unable to refinance at the time of the debt’s expiration in October 2015.

The $55 million note is the largest in CD 2005-CD2, accounting for 25.62 percent of the conduit’s remaining collateral. Additionally, 10 of the 15 largest loans in the pool are currently with the special servicer.

The 13-building suburban office complex was constructed in phases, starting in 1991 and ending in 2005. Rhodia occupied 8 Cedar Brook Drive, which is the newest building among the collateral properties. At the time of the loan’s origination, Cedarbrook was 99.53 percent occupied.

In March, Robert Verrone’s Iron Hound negotiated another extension on a different commercial mortgage-backed securities deal. New York-based Two Trees Management Company received a two-year extension on a $195 million note backed by J.P. Morgan International Plaza I & II, a 756,851-square-foot office complex in the Farmers Branch suburb of Dallas.

The debt modifications come during a time when there is a total of $50.88 billion across 2,204 office loans waiting to be refinanced as part of the CMBS maturity wave, according to data from Trepp. Those mortgages account for 31.14 percent of the remaining $163.34 billion yet to mature as part of the wave.

Representatives for Eastern Properties and LNR did not respond to requests for comment, and representatives from Iron Hound were not available to comment.