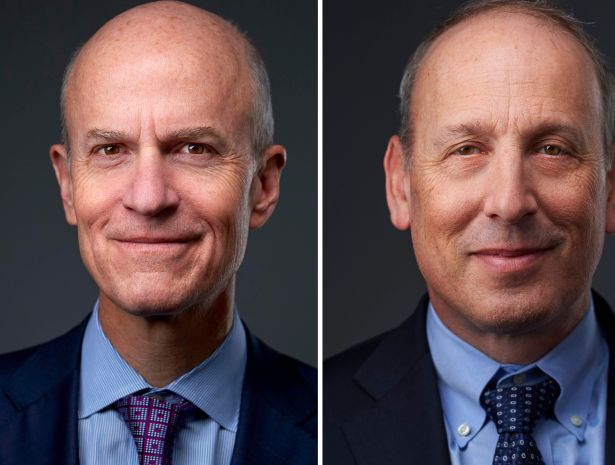

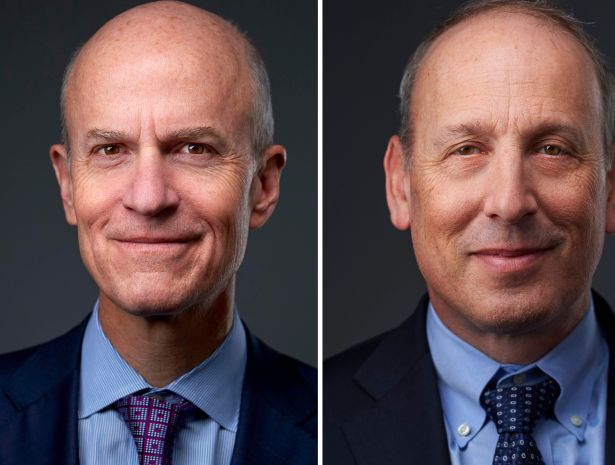

Owen Thomas (left) and Douglas Linde (right).

Owen Thomas and Douglas Linde

CEO; President at Boston Properties

Last year's rank: 19

Despite still facing challenges from increasing remote-work trends, Boston Properties expanded its reach in 2021 through several acquisitions.

The company acquired 360 Park Avenue South in December for $300 million from Empire Asset Management, signaling Boston Properties’ entry into the Midtown South submarket. The largest publicly traded owner of Class A office properties embarked on upgrades to the 20-story building, which became vacant shortly after the purchase, as a way to attract new media and tech tenants often drawn to the submarket.

The real estate investment trust also purchased Safeco Plaza in Seattle for $465 million in July. Seattle is the sixth U.S. market Boston Properties has entered, and the REIT announced its second acquisition in the Pacific Northwest city in April with an agreement to buy the 37-story Madison Centre office tower for $730 million.

The past year also marked Boston Properties’ expansion in the life science sector with its acquisition last July from Lantian of the seven-building Shady Grove Bio+Tech Campus in Montgomery County, Md., near Washington, D.C., for $116.5 million. It is planning to convert the office buildings in the 31-acre property into lab space. The asset adds to the firm’s more than 1 million square feet of lab development and redevelopment projects under construction and scheduled to deliver in the next three years.

“In 2021, we demonstrated the resilience and stability of our business during another challenging year due to the ongoing COVID-19 pandemic,” Owen Thomas and Douglas Linde wrote in an April letter to shareholders. “We developed and delivered several extraordinary, high-quality properties, completed large levels of leasing across our regions, enhanced existing assets, entered new markets, and divested select portions of our portfolio.”

Another big move for Boston Properties during the last year involved the hiring of commercial real estate veteran Hilary Spann from CPP Investments as executive vice president of its New York region, replacing John Powers. Prior to CPP, Spann spent a decade at JPMorgan Chase, where she focused heavily on the Manhattan office market, completing 27 transactions totaling $12 billion in gross asset value.