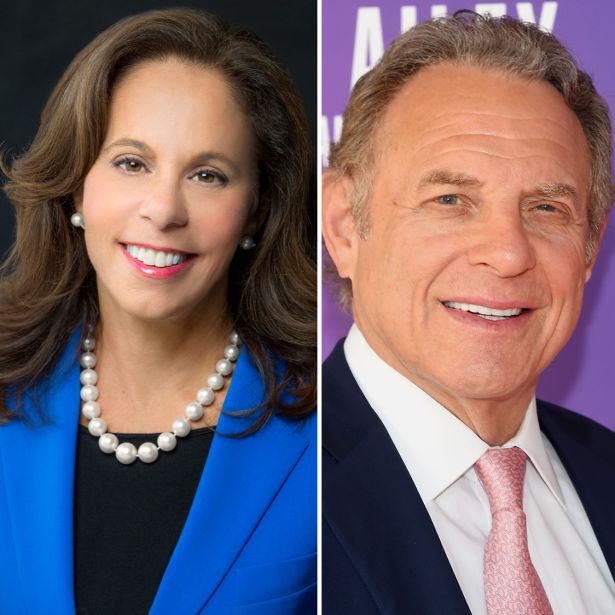

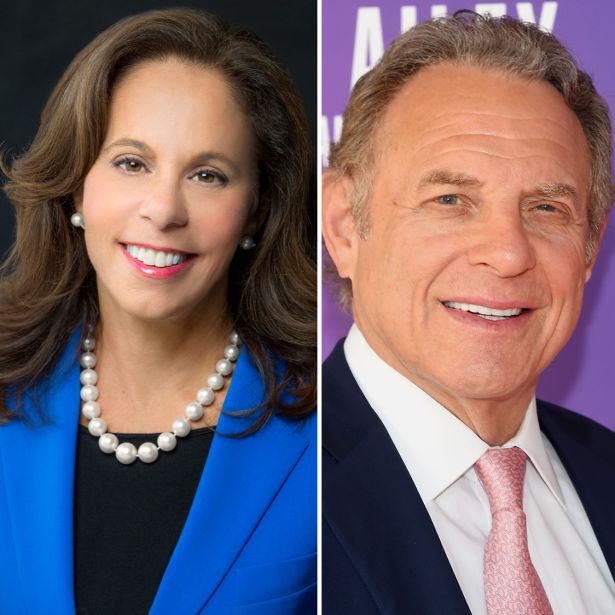

Leslie Himmel and Stephen Meringoff

Leslie Himmel and Stephen Meringoff

Co-founders and Managing Partners at Himmel + Meringoff Properties

Last year's rank: 86

If there was one thing that Stephen Meringoff wanted to relay on behalf of himself and partner Leslie Himmel at the end of April, it was to “never ever count out New York. We always come back from everything.”

As primarily office owners in New York City, the health of Himmel + Meringoff Properties closely mirrors the health of the Big Apple’s workforce.

Himmel and Meringoff recognized early on in the pandemic that they were going to have to make capital contributions to their portfolio to entice and retain tenants. Following those investments, Himmel + Meringoff scored three of the city’s biggest office leases — all of 65,000 square feet or more — in the last half of 2021. “That’s amazing for a company of our relatively small size,” Meringoff said.

One of those deals was for software company DoubleVerify, which took 87,500 square feet at 462 Broadway. “We bought out a tenant there to make this happen,” Meringoff said.

As of April 2021, the pair started to see a recovery as “people were returning to the office,” Meringoff said.

The firm continued its investment in life sciences (at its 525 West 57th Street) and last-mile distribution (at its 300,000-square-foot industrial property in the Parkchester area of the Bronx). “And we continue to look for other acquisition opportunities in office, life science and industrial,” Himmel said. “Our bigger focus this year was really investing in our properties and making sure that we can keep them full.”

Indeed, the firm was able to accomplish that through its leasing team “being in the office” since June 2020, “being very aggressive with showing space and having lots of tours, when others were still really just not working from Manhattan,” she said.

Of its 2 million-square-foot portfolio, the assets are less than 10 percent vacant in what Meringoff called “a 20-plus vacant city.” He added, “That’s damn good.”

The dynamic duo hopes new opportunities will materialize. “We look forward to acquisitions,” Himmel said. “We also think that purchasing pieces of debt and/or helping lenders may be also a path to acquisitions.”