Jason Alderman

Jason Alderman

Senior Managing Director, Co-Head of New York Office at Hines

Tell us about a deal that did NOT go through this year and why it didn’t happen.

We were outbid by a user-buyer on a fantastic building in Greenwich. I’d rather lose to a user than a competitor!

Have you refinanced anything in 2022? How difficult/easy was it?

No refinancings this year. We have two deals under contract now that, through Hines’ investment management platform, we are going to be in a position to close all-cash.

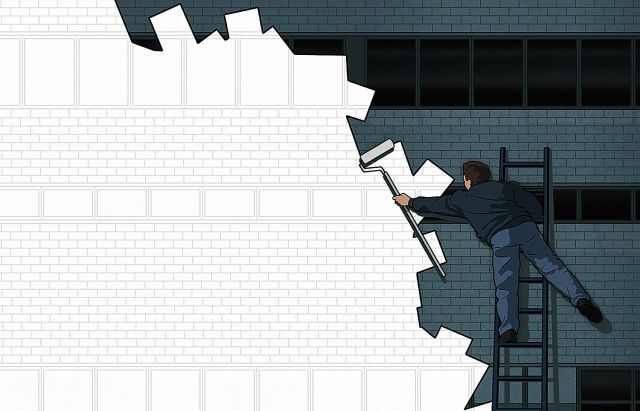

There’s a lot of Class B and C office in NYC. If you could lay your hands on them at a really great price, what would you do with them?

We have been looking at a lot of deals with this profile. We gravitate towards multifamily if the physical attributes work; however, we have explored student housing and self-storage uses as well. There have been some exceptions, but generally we have not seen the market pricing them at a level low enough to justify conversions — I think we have a bit more time for things to work themselves out.

What market outside of NYC do you like and why?

We love the entire tri-state area outside of the city, with active residential and industrial projects in Northeast Pennsylvania, Westchester, Long Island and Connecticut. These projects generally are in supply-constrained areas with strong underlying demand.

There’s a midterm election this year. How closely are you following, and do you think the national political climate will have an effect in New York?

NYC will benefit materially from some of the transit funding, which will enable projects like Gateway to move forward. I generally keep track of what is going on, but I’m not obsessing over it.

How many days per week are you in the office?

Four.

How many days per week are your tenants in the office?

We have some tenants in five days a week, but generally two to three days a week.

NYC apartment rents have reached never seen levels. How much further can it go? How does the housing squeeze play out?

It has made me very happy (as a New Yorker, not a real estate owner) to see everyone come back to the city since the depths of the pandemic — lots of people still want to be in NYC for all the reasons they always have. Ultimately, wages will be a governor on rent growth, and I think we are starting to see that. We have a lot of demand from people who want to live here and an extremely supply- constrained market, so when you get incoming population growth or wage growth New York rents tend to accelerate quickly. We need to build more housing.

ESG: fad or fixture?

Absolutely a fixture — but we are in the early innings for both tenants and owners. Our team at 555 Greenwich is about to deliver New York’s first geothermal office building that also uses its concrete slab to provide heating and cooling. We will outperform NYC’s 2030 climate targets by over 45 percent.

Class quote

“GO NEW YORK!”