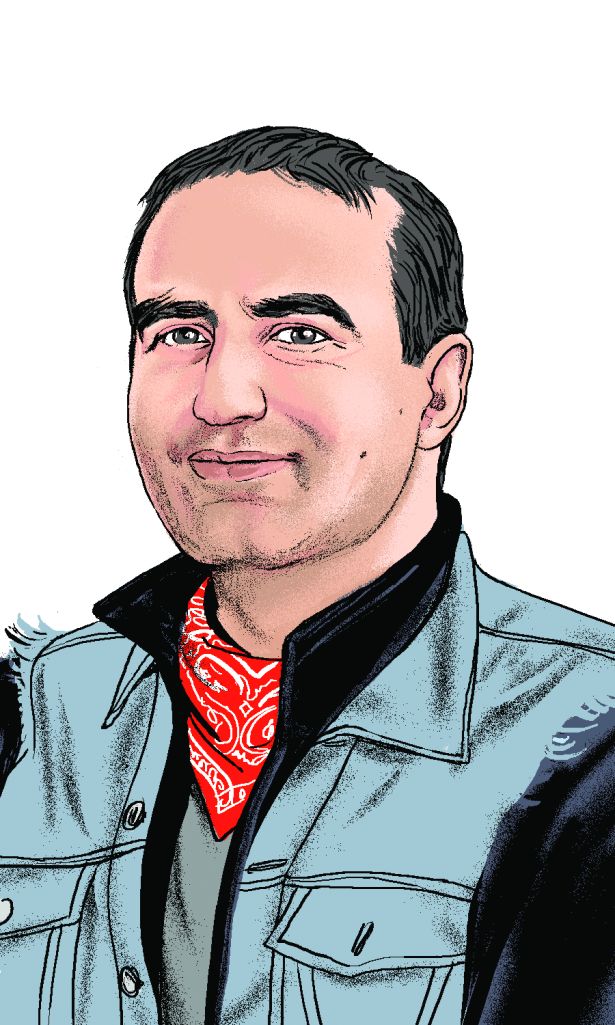

Justin Elghanayan

Justin Elghanayan

President at Rockrose

Tell us about a deal that did NOT go through this year and why it didn’t happen?

Some sellers just see rent increases this year and set unrealistic price expectations, not considering inflation’s impact on construction costs, operating expenses, financing rates and other factors. We’ve avoided a few acquisitions when sellers have not been flexible with their pricing.

Have you refinanced anything in 2022? How difficult/easy was it?

Shifting dynamics in the capital markets have been challenging in 2022, but, thanks to our long history and relationships, top-tier lenders have remained eager to lend to us.

There’s a lot of Class B and C office in NYC. If you could lay your hands on them at a really great price, what would you do with them?

It’s too easy to say these commercial buildings should be converted to residential to solve the city’s housing shortage. When conversions were successful in the past, such as in Lower Manhattan, tax abatements were associated with them. There is not much political appetite for new financial incentives for development right now.

What market outside of NYC do you like and why?

Rockrose has stayed committed to developing housing in NYC for the past 50 years, but for the first time in our history we are exploring markets outside of New York state. Money can travel, and there are several attractive markets outside of New York.

There’s a midterm election this year. How closely are you following, and do you think the national political climate will have an effect in New York?

The future of housing development in New York is extremely dependent on state actions, so I’ve been focused more closely on the state elections.

How many days per week are you in the office?

Usually four or five days per week.

How many days per week are your tenants in the office?

Most are in the office at least three days a week, but we continue to see more people returning since Labor Day.

NYC apartment rents have reached never seen levels. How much further can it go? How does the housing squeeze play out?

The underlying issue is a supply problem. Until New York focuses on incentives to produce new housing, I don’t see rents going down significantly. Unfortunately, the electeds in New York are currently doing the opposite, removing incentives for developers to build new housing.

ESG: fad or fixture?

Interest in ESG will diminish over time but won’t completely go away.