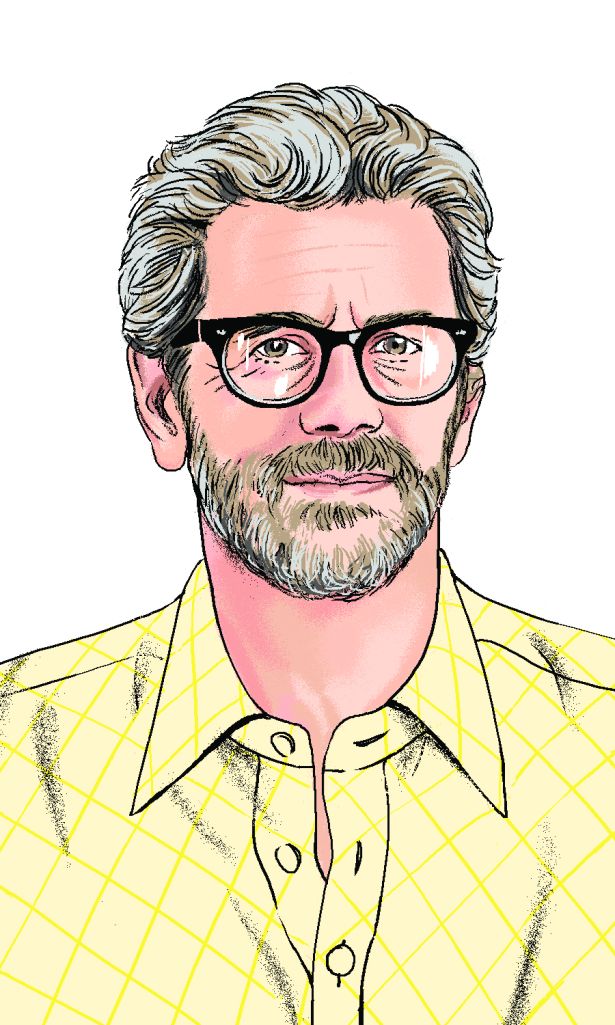

Anthony E. Malkin

Anthony Malkin

President and Chief Executive Officer at Empire State Realty Trust

Have you refinanced anything in 2022? How difficult/easy was it?

We are fortunate to have a modestly levered balance sheet, a weighted average debt term of approximately seven years, no maturity until November 2024, and our debt is all fixed-rate with a weighted average cost of 3.9 percent. My lessons from the past have framed ESRT’s balance sheet optimization and ensured we have flexibility and access to capital markets.

There’s a lot of Class B and C office in NYC. If you could lay your hands on them at a really great price, what would you do with them?

We are expert in the conversion of older assets into modernized, amenitized, energy-efficient assets that boast indoor environmental quality and healthy building practices. We spent more than $1 billion on our portfolio’s redevelopment. We are the lowest carbon emitter of all NYC-based REITs, according to Green Street; carbon neutral; and an accessibly priced destination for business’ flight to quality. If we can buy at a price that in today’s market will allow us to bring an asset to these standards and make a great return, we will look at it.

What market outside of NYC do you like and why?

There is no market in which we are more confident than New York City. We have seen rapid expansion with unrestricted construction in other markets, and we know that no other market matches the lure and energy of New York City. We believe in New York City, and we are fortunate to have our portfolio here.

There’s a midterm election this year. How closely are you following, and do you think the national political climate will have an effect in New York?

Safety, schools and return to work are important to New York City, and we need local and state politicians who recognize that there is work to be done legislatively and have the political will to do it. We still need to assess tax policy and the reasons why some people have moved away from the city.

How many days per week are you in the office?

When I am in town, I am in the office five days each week.

How many days per week are your tenants in the office?

We’ve noticed a peak Tuesday through Thursday. Attendance continues to build on those days, as well as Mondays and Fridays.

NYC apartment rents have reached never seen levels. How much further can it go? How does the housing squeeze play out?

Truthfully, on an adjusted basis, rents are only modestly higher than they were in 2019. With inflation, they are not above 2019. Wages have increased, as well. Many new households were formed when people who used to room together used the downturn to rent their own places during the pandemic to work from home. Along with increased prices, as people return to the office, people will likely seek roommates again. Over the long term, the city and state must put regulations in place — like a 421a program that works — to address the housing crisis and accommodate more affordable housing for all. Until Albany takes these steps, housing in New York City will remain in the luxury market.

ESG: fad or fixture?

The “E” (environment) and “S” (social) are certainly fixtures. Greenwashing and soft sustainability measures are the “E” fads that are on their way out, and science-based targets and hard data will dominate the future. As legislation continues to demand caps on energy and emissions, companies will need to comply. “S,” or culture, is critical, and our changes in our own business here have enabled us to make massive advances throughout the pandemic and after. We were deliberate and strategic in our “S” moves, and there is nothing that we did from January 2020 through today that we plan to change. We are fortunate to be in the position we are today. As for the “G,” governance has always been a focus for companies. It’s nothing new.