Michael T. Cohen, principal at Williams Equities.

Michael T. Cohen

Principal at Williams Equities

How much longer can this go on?

The robust return to normal that people are waiting for requires more than just the indigenous return of New Yorkers to their homes and offices. It requires the rest of the country and the world returning to New York City as a world-class destination, and a stronger commitment from companies to bring workers back to the office.

Until workers and tourists return to New York in volume, the local economy is going to continue to operate with one hand tied behind its back. We see this in the fortunes of small businesses throughout our portfolio. For example, many restaurants, as well as entertainment and other hospitality-related businesses have either closed their doors or adapted, but have not yet returned to pre-pandemic foot traffic and revenues.

I worry that the kind of recovery we’re all eager to see is at least a year away, but I also feel confident that the product that is New York City will promote itself successfully and offer great value to those who embrace it. People will return. But we still need a greater commitment from the private sector to bring employees back to the office, catalyzing the local economy.

What does normal look like?

The biggest characteristic of the new normal is that we’ve all discovered how incredibly efficient we can be using technology instead of traveling. That includes telecommuting or conducting meetings virtually with people all over the city and the world from the convenience of your desk. I am now capable of being much more efficient. So that raises important questions: As time progresses, are we going to spend more time in our houses, and, if so, what will be the effect?

Despite the convenience and efficiencies virtual meetings can provide to varying degrees, I would argue that even if not all employees return to the office full time, a hybrid model will be a significant competitive advantage over companies who either allow full-time telecommuting or take a passive approach in reassembling teams in person. The companies that safely bring back the largest percentage of their workforces in the shortest period of time are those more likely to win new business at a time when it is most critical to do so.

If you could go back in time to March of 2020, what’s the first thing you would do?

I’d buy a Dow index. I don’t know anywhere else where you can get a 50 percent return on your money in a year and a half.

What do you do now that you never did before 2020?

Wear a mask. I keep one in my pocket and wear one indoors at all times with the exception of my home.

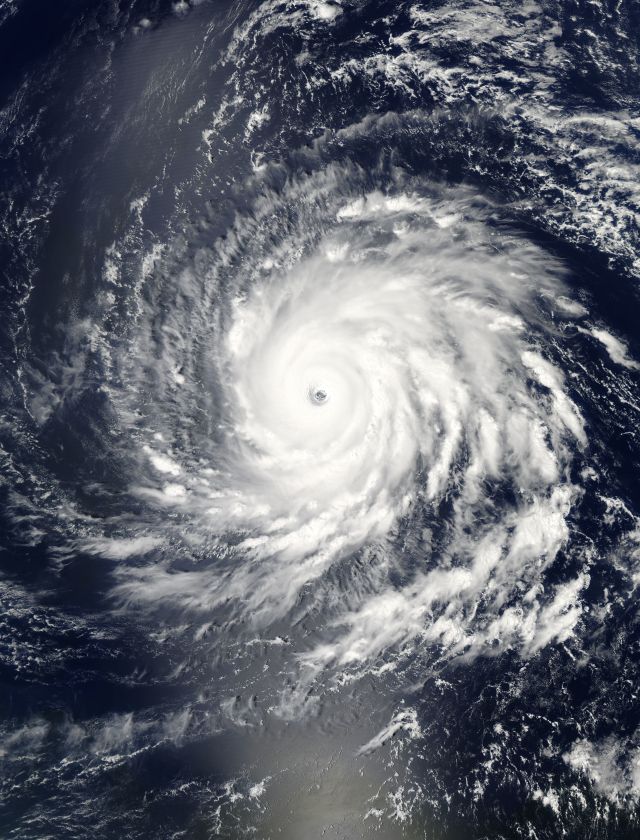

What’s the biggest threat to the return to normal?

The resistance to science and lack of a global strategy. We need to relegate the virus to the likes of the flu.

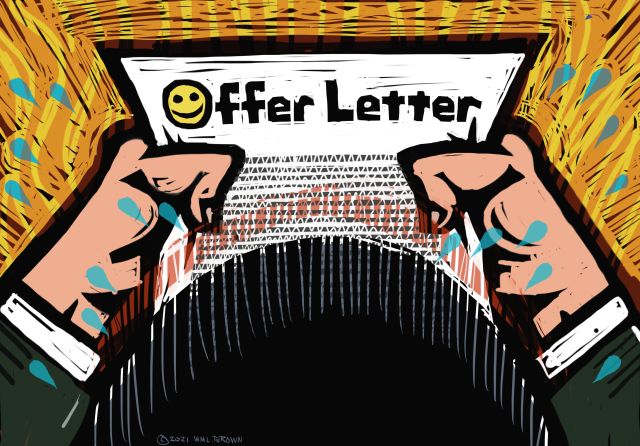

Is now the time to buy or sell?

It depends on the asset class. Now is a great time to invest in New York City office product. And, if you are the owner of a stabilized office asset, this is also a great time to sell because it can appeal to buyers looking for safe returns.

Suddenly, there’s a big change to the New York state constitution and you’re now named the 58th governor of the Empire State — what do you do about the eviction moratorium?

There has to be a better way to do the right thing for the stakeholders in this dilemma than a moratorium.

Lightning round

Last time you got on an airplane,

what was your destination?

New Orleans.

What vax did you get?

Pfizer.

Your go-to takeout?

Bareli’s by the Sea in Spring Lake, N.J.

Where does your patience wear thinnest — evictions or anti-vaxxers?

Anti-vaxxers.