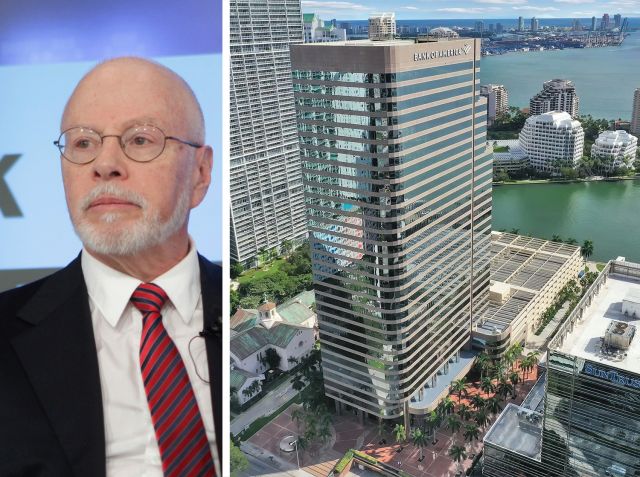

What was long a destination for its lifestyle and hospitality has become a national magnet powerful enough to pull in every kind of investment.

Everyone wants a piece of South Florida. And those who already have some want more.

“Florida used to be a place for sun and fun, and that’s completely changing,” said BH Group’s Isaac Toledano. “You cannot ignore what’s going on in Florida. It’s only getting stronger and stronger.”

Other major cities want to be more like those in Florida, where brokers have been closing deals rather than throwing their hands in the air for the past five years. And now the state continues to reap the benefits as the rest of the world finally comes back around to in-person work.

“Before the pandemic, I couldn’t understand why people criticized Miami, and didn’t regard it as a front-line American city,” said Jonathan Goldstein, who described his Cain International as “early miners in South Florida.”

This year’s Power South Florida list reflects the institutions that built the region into a national commercial real estate powerhouse, including the newcomers making some of the biggest moves.

South Florida boasts a seemingly endless and ever-growing pipeline of luxury residential development, especially since the pandemic’s influx of outsiders. And those developments need a lot of construction financing, with astonishing numbers sprouting up throughout the area in the past year.

Bank OZK’s leadership commanded a spot on the list after securing nearly $1 billion in total financing for two different residential projects, one in Miami and the other in Miami Beach.

Same for Mast Capital, which earned a spot after securing $600 million for one luxury residential project last year and then a $390 million loan this year for a different one. Again, one was in Miami and the other in Miami Beach.

Or there was Tyko, which crashed the scene with $527 million for the 50-story St. Regis-branded condo tower in Brickell and $424 million for an oceanfront project in Bal Harbour.

And, of course, the players behind the biggest deals of the past year made our list. Oak Row led the way with an eye-popping $520 million to buy a waterfront Brickell property. BH Group completed more than $300 million in acquisitions in 2024 (and broke ground on a $1 billion project off the southern tip of Miami Beach). Even grocery chain Publix put down $250 million on six retail centers that it anchors.

“I can’t imagine not being here for the rest of my life,” said Jeff DiModica, president of Starwood Property Trust, which expanded its South Florida exposure by 20 percent last year.

Too bad the secret’s out. —Gregory Cornfield