Ben Brown

Managing partner at Brookfield Real Estate

Are you going to buy in `25? If so, what asset class?

Yes. We have been very active already this year and the pipeline of activity continues to build. We look for dislocation and value across all sectors. But, so far in 2024, we have acquired (or have under offer) $4.5 billion in housing assets alone. Stress in the sector is creating deep discounts to entry and supporting opportunistic returns on core-like product, so it has been an interesting sector for us to acquire larger-scale deals with the competition limited.

Is there a single “good” sign you see in a distressed property that makes you want to buy it?

Lack of capital. When you can identify a disconnected relationship between fundamentals and capital availability, you can buy great assets at deep value. We have data coming into us daily across our global real estate business that allows us to run at these opportunities when they become apparent.

What real estate or tax policy would you like to see from the Trump administration?

Revoking discriminatory FIRPTA [Foreign Investment in Real Property Tax Act] rules that deter healthy and appropriate capital investment from outside the U.S.

Let’s talk about office. Is the worst over?

Absolutely, if you own premier properties. Demand for the best space continues to explode, and with supply of newly constructed or redeveloped space not growing anytime soon, we are starting to see demand cascade to the next tier down. If you own commodity office space, there is still pain to be felt, but by now you know if your building is leasable or functionally obsolete.

Which market (outside of NYC) do you like best?

We are bullish on San Francisco over the long term. Every real estate cycle, people call the death of San Francisco, and it always comes back. It’s the center for all intellectual property in the U.S. Tech will only continue to play a larger role in our lives, and San Francisco will be a beneficiary of that.

We are also very bullish on the recovery settling in across the main markets in Canada. Demographics are very supportive, supply going forward is very constrained, and capital has been more scarce than typical across many sectors.

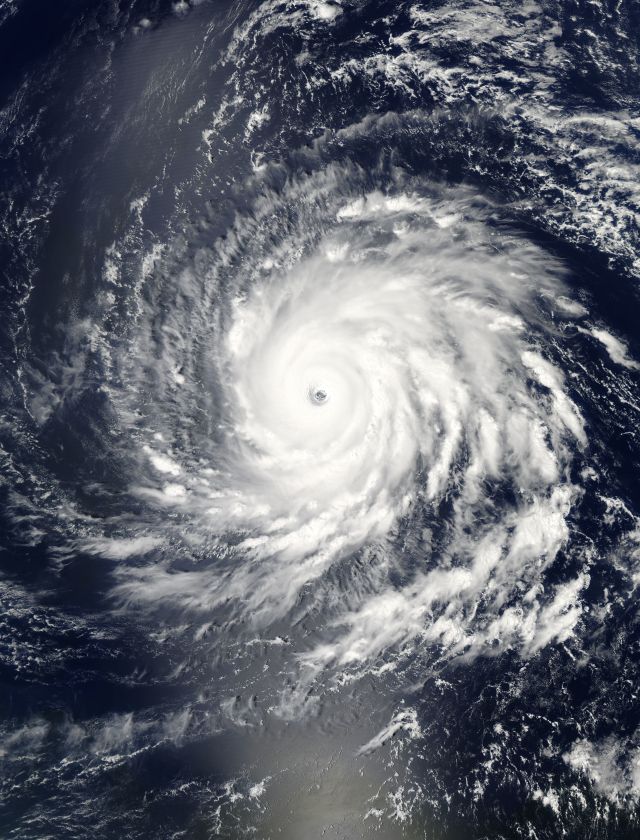

What’s going to be your biggest expense in 2025?

Insurance, especially given the increase in natural disasters. Certain markets continue to see real risk in rising insurance costs.

How’s the financing climate for new development and redevelopment — hot, cold or just right?

Cold. You can buy and finance assets today below replacement cost, so there is very little appetite for lenders to take development risk.

What are your predictions for the mayor’s City of Yes, especially given the controversies within the Adams administration?

City of Yes not only recognizes the need for growth in New York City, especially in the supply of housing, but it also sets forth practical policies to address it. Meaningful changes are hard to achieve even in times without controversy, but, by all accounts, the mayor remains driven to get stuff done, and I have a lot of confidence in and respect for First Deputy Mayor Maria Torres-Springer.

Do you still like Eric Adams? (Did you ever like him?)

The mayor is still the mayor, and there is plenty this city needs from his administration to move us forward.

Lightning Round:

Your social media of choice?

LinkedIn.

AI: Helpful in CRE or a fad?

Helpful.

Last movie you saw in a theater?

“Inside Out 2.”

You’re going on a six-month expedition into the Amazon. What’s your last meal before you get on the plane?

Daily Provisions’ bacon, egg and cheese.

Tesla or BMW?

Uber.

If you could partner with one person in the business on a property, who would it be?

Howard and Michael Milstein, or Larry Silverstein.

What are you tired of talking about?

Politics.