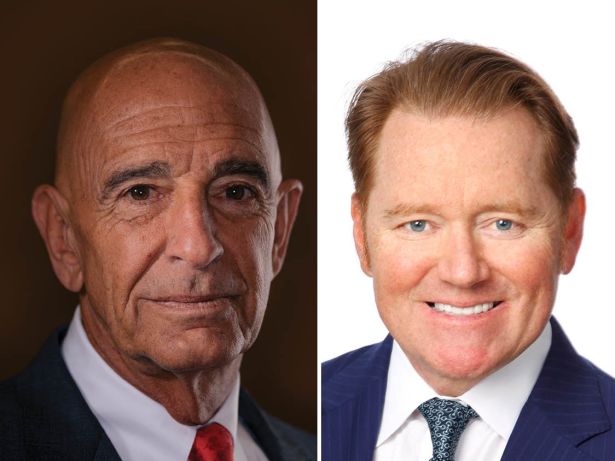

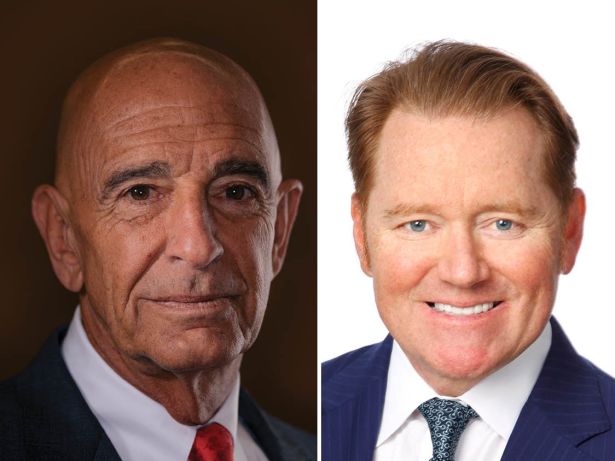

Thomas Barrack. Marc Ganzi

Thomas Barrack and Marc Ganzi

Executive chairman; CEO at Colony Capital

Every social media post and every text message, all streaming services and all apps, the photos and contacts stored in your cloud, and this entry in the Power 100 list — they all required more data, and more data needs more and more space every day.

As life continues to move online, Colony Capital is betting on advancements like 5G, artificial intelligence, and expanding internet access will demand more valuable infrastructure. The digital expansion is also noticeably pandemic-proof, considering people continue to share photos, watch Netflix or dance on TikTok when they shelter in place.

Colony spent July doubling down on its digital infrastructure gamble. The firm bolstered its digital portfolio with a $1.2 billion data center investment in a new partnership with Vantage Data Centers.

Founder Thomas J. Barrack — noted friend of President Donald Trump — also exited his role as president and CEO July 1. He was replaced by Marc Ganzi, who founded Digital Bridge and came to Colony after it acquired his firm and its internet infrastructure for $325 million one year ago. Barrack will remain as executive chairman and said Ganzi will position the firm to be the “premier investment partner for companies enabling the next generation of mobile and internet connectivity.”

“Three years ago we embarked on a pivot to the digital frontier and its incredible potential of growth and opportunity,” Barrack said in a statement.

Further, on July 13, Digital Colony — the firm’s digital infrastructure platform — sold a minority stake to Wafra Inc., which will provide Colony with more capital to pursue more cell towers, data centers and fiber systems. In total, it’s expected that Wafra’s investment will total more than $400 million.

Colony believes so much in data infrastructure that it sold its industrial operating platform to Blackstone in a time when that sector continues to see rapid expansion. The $5.7 billion deal was one of the biggest in 2019, advancing Colony’s “strategic transformation to digital infrastructure.”

Los Angeles-based Colony continued shedding logistics properties last year and unloaded nine-figure portfolios to Nuveen Real Estate and Lincoln Property Company to bulk up its digital real estate platform.

The company manages a $50 billion portfolio of assets, including more than $20 billion in digital real estate investments.—G.C.