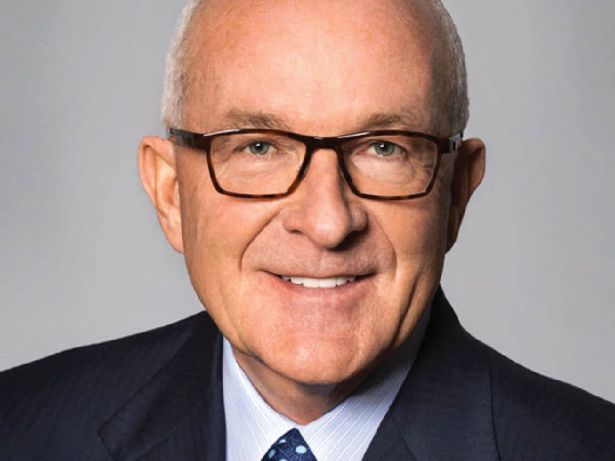

Albert Behler

Albert Behler

Chairman, CEO and President at Paramount Group

Last year's rank: 55

A tale of two coasts, Paramount Group is not one to be trifled with in New York and San Francisco. The real estate investment firm owned about 13.1 million square feet by the end of last year, about 96 percent of which was leased.

Heavily concentrated in New York and San Francisco — 8.6 million square feet and 4.3 million square feet at the end of 2019, respectively — the vertically integrated, publicly traded REIT can lay claim to 1633 Broadway and 1301 and 1325 Avenue of the Americas in New York as well as 300 Mission Street, One Market Plaza and Market Center in San Francisco, among more than a half-dozen other premier office buildings in these massive gateway markets. Paramount is also strapped with a series of fund vehicles that originate throughout the capital stack — mortgages, mezzanine loans and preferred equity investments.

Leasing being one of its strong suits, according to Albert Behler, the firm leased around 1.5 million square feet last year, with average starting rents at about $90 per square foot, smashing its 2019 goal to lease between 600,000 and 900,000 square feet. And it was also able to eliminate approximately 80 percent of this year’s rent roll in New York and San Francisco. (However, it should also be noted that when Barclays vacated 1301 Avenue of the Americas it left a 500,000-square-foot gap that Behler said on an earnings call probably wouldn’t be filled until 2021.)

Over the course of last year, it continued its expansion in San Francisco, acquiring 49 percent, 44.1 percent and 67 percent interests in 111 Sutter Street, 55 Second Street and Market Center, respectively. Somewhat surprisingly, it made its first purchase in the city only four years ago.

Last November, it was able to bag a $1.25 billion refinance of its 2.5 million-square-foot office property at 1633 Broadway, pocketing about $179 million in proceeds. And then in late May, it closed on its sale of a 10 percent joint-venture interest in the property, which overall is valued at around $2.4 billion.

“As in the past, we will look to redeploy those proceeds accretively into stock repurchases and value-add acquisitions,” Behler wrote in the company’s 2019 annual report. “We will continue to stay disciplined and opportunistic in managing the portfolio and evaluating potential acquisition and disposition opportunities, remaining prudent with shareholder capital in order to maximize stable, long-term returns.”

The 42-year-old enterprise, which became a publicly listed REIT in 2014, announced in early March — just before the outbreak hit the East Coast — that it was in contract to sell one of its only remaining assets outside of its two core markets. It unloaded the 11-story, 191,000-square-foot office property at 1899 Pennsylvania Avenue in the nation’s capital, about three blocks from the White House, for $115 million in a deal that is expected to close in the fourth quarter of this year.

“With the successful sale of 1899 Pennsylvania Avenue, we have now strategically sold all five of our wholly owned assets in Washington, D.C.,” Behler said in a statement at the time the sale was announced. “This transaction once again demonstrates our determination to sell stabilized or noncore assets and redeploy that capital into higher growth opportunities.”—M.B.