Wharton Properties Faces Foreclosure From Rialto at 144 Fifth Avenue Over $8M Loan

By Isabelle Durso April 24, 2025 5:04 pm

reprints

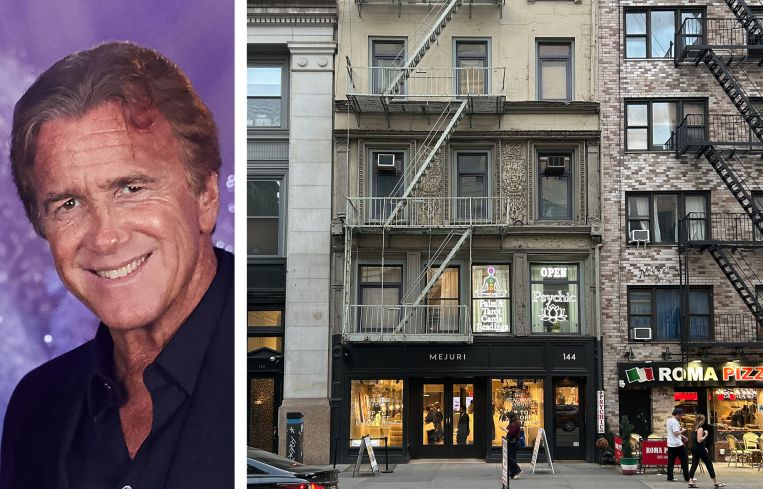

Jeff Sutton’s Wharton Properties has been hit with a pre-foreclosure filing at its retail co-op in the Flatiron District.

Wharton is facing foreclosure at the retail co-op at 144 Fifth Avenue after defaulting on an $8 million loan for the property, according to a recent filing by loan servicer Rialto Capital Advisors in New York County Supreme Court.

Rialto claimed in the filing that Sutton failed to pay off his debt in full by February 2024 and failed to forward the rents he collected from tenants at the building, including jewelry store Mejuri, to Rialto as he was required, according to The Real Deal, which first reported the filing.

Since the filing, Wharton and Rialto have clarified there was “no misappropriation of rents.”

“Wharton Properties has provided the information which makes clear that there was no misappropriation of rents,” Wharton and Rialto said in a joint statement. “Wharton and Rialto continue to work together to reach a resolution that benefits all parties involved.”

Sutton bought the ground lease on the Fifth Avenue building between West 19th and West 20th streets in 2016 through the $8 million loan from the now-defunct Signature Bank, which was shut down by regulators in 2023 thanks in part to its heavy exposure in cryptocurrency.

Rialto then took over servicing on Signature’s $17 billion loan book in a joint venture with Blackstone and a subsidiary of the Canada Pension Plan Investment Board.

The five-story Flatiron District building, which Sutton controls, also comprises a residential unit. Retail tenants of the property include Tarot card reading service Physic Temple and tailor David Samuel Menkes.

This isn’t Rialto’s first foreclosure filing this month.

The loan servicer also started foreclosure actions against Thor Equities and Premier Equities at their retail condominium in SoHo at 25-27 Mercer Street, as Commercial Observer previously reported.

Update: This story has been updated to include a statement from Wharton and Rialto.

Isabelle Durso can be reached at idurso@commercialobserver.com.