Douglas Development Sells Three D.C. Properties for $96M on Final Day of 2024

By Nick Trombola January 8, 2025 6:25 pm

reprints

One of Washington, D.C.’s biggest commercial landlords spent the last day of 2024 finalizing the sale of three of its properties inside the District.

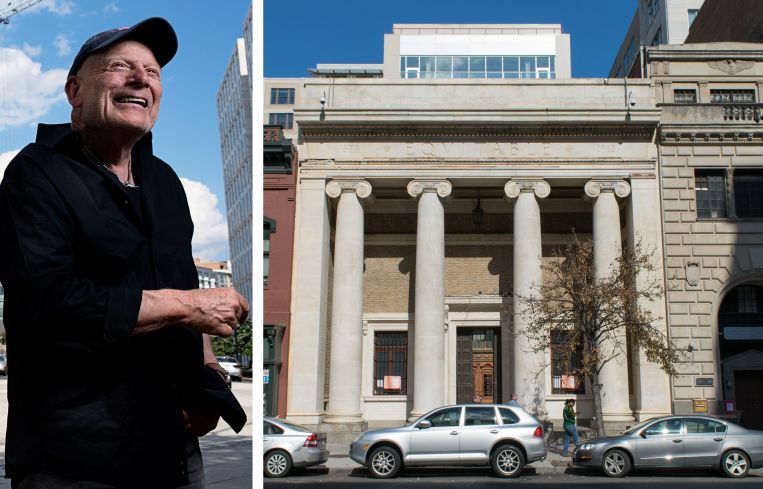

Douglas Development traded three properties — the former Pappas Tomato Factory building at 1401 Okie Street NE, the historic Equitable Co-Operative Building Association property at 915 F Street NW, and a 16-acre parcel near the National Arboretum — for a total of $96 million, according to Bisnow. American Armed Forces Mutual Aid Association (AAFMAA), which provides financial services to U.S. servicemembers, acquired the properties.

Douglas had previously redeveloped 1401 Okie Street into 94,000 square feet of retail space, and it now serves as the home of Compass Coffee, as well as restaurant Gravitas and live music bar and restaurant Throw Social. The building at 915 F Street NW, built in 1911, is now the second location of popular D.C. restaurant Succotash.

As for the 16-acre parcel, Douglas had originally intended to redevelop the area into a 1.5 million-square-foot, mixed-use district which it dubbed New City D.C. But the developer earlier this year instead filed a rezoning application to build out the site into a 186,000-square-foot industrial property.

A 99-year ground lease for 10 acres of that property, worth $25.6 million, was also assigned on Dec. 31 to an entity connected to the developer, Jemal’s Schaeffer Tenant LLC, per Bisnow.

Representatives for Douglas and for the AAFMAA did not immediately respond to requests for comment.

Douglas Development had an interesting year 2024, experiencing both ups and downs across the 19 million square feet of leasable space in its portfolio. Aside from landing in November a $36 million refinancing package from the Bank of Montreal toward one of its office towers in Delaware, the developer in August paid just $34.3 million, a relative steal, to acquire the 138,000-square-foot office at 701 Eighth Street NW from an affiliate of Voya Investment Management.

Yet earlier that same month, Douglas defaulted on a $51.6 million commercial mortgage-backed securities loan tied to 14 properties across the DMV.

Nick Trombola can be reached at ntrombola@commercialobserver.com.