Douglas Development Defaults on D.C.-Area Portfolio CMBS Loan

By Nick Trombola August 28, 2024 7:37 pm

reprints

Property loan defaults in Washington, D.C., seem to be as common as Capitol Hill staffer happy hours these days, with the latest coming from Douglas Development.

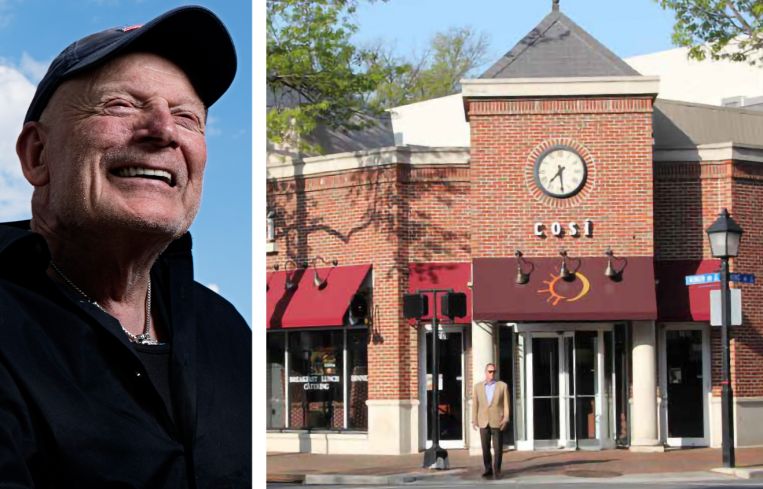

The firm, one of the largest owners of property in the District, defaulted on a $51.6 million commercial mortgage-backed securities (CMBS) loan tied to 14 properties in the DMV when the loan matured on Aug. 1, according to Bisnow, which cited data from Morningstar.

Ten of the properties are in the District proper, with three others in Old Town Alexandria, Va., and the final one in Rockville, Md. The properties range from 3,000 square feet to 41,000 square feet, per Bisnow.

The loan originated from the Royal Bank of Scotland in 2014, though it was sold to an unnamed CMBS trust later that year, according to the Business Journals.

The debt was initially tied to 15 properties, but Douglas sold 100 King Street in Alexandria to Alexandria Restaurant Partners for $8.6 million in 2022. Occupancy of the remaining 14 properties averaged 83 percent in March of this year, per Bisnow, though the debt was transferred to special servicing in July ahead of its maturity date.

Representatives for Douglas did not immediately respond to a request for comment.

Despite the distress, D.C.-based Douglas remains a top owner of office, residential and retail space in the DMV, with dozens of properties comprising some 14 million square feet under its wing in the region.

It also has a sprawling, if evolving, development project near the National Arboretum in Northeast D.C. The firm for years has planned to build a 1.5 million-square-foot office, hotel and residential district there dubbed New City D.C., but earlier this year filed an application to rezone part of the site to make way for a 186,000-square-foot industrial property.

Nick Trombola can be reached at ntrombola@commercialobserver.com.