The 10 Biggest U.S. Commercial Real Estate Loans of 2024

The top deals involved assets as varied as a Vegas mall, a Miami resort, a Manhattan office project and a data center in Dallas

By Andrew Coen December 11, 2024 6:00 am

reprints

Commercial real estate lending began to pick up speed in 2024 with several large and notable deals across a number of property sectors, both in the public and private markets.

The year’s biggest deal closed in October via the commercial mortgage-backed securities (CMBS) market with a $3.5 billion securitization on Tishman Speyer’s 13-building Rockefeller Center office and retail complex. The transaction gave a boost to an office market still struggling from the fallout of the COVID-19 pandemic with strong investor demand that demonstrated confidence in the future of higher-quality Class A assets.

Lenders also showed conviction in the hospitality and residential markets. Cain International, for instance, received $2 billion of construction financing to build two luxury residential towers and a 10-story hotel in Beverly Hills in a deal led by J.P. Morgan Chase. Four months later, Gary Barnett’s Extell Development scored a $1.2 billion loan from JVP Management to refinance an Upper West Side condominium tower at 50 West 66th Street.

Here is a list of the year’s biggest CRE financings nationwide. It includes a mix of the largest single-

asset, single-borrower CMBS deals from Morningstar data and sizable off-balance sheet transactions. Most of these fell within a few states — for that matter, six were in Manhattan — and most involved refinancings.

Commercial Observer checked the information against our coverage, too.

Rockefeller Center

$3.5 billion refinancing

The October CMBS deal for the iconic Midtown Manhattan office and retail complex ended up oversubscribed from its initial pricing levels to close with a fixed interest rate of 6.23 percent after starting off at 6.5 percent.

The transaction, which was co-originated by Bank of America and Wells Fargo, marked the largest CMBS issuance ever for a single office asset (no “pre-” and “post-” COVID modifiers needed here!). Tishman Speyer, which co-owns the famed Midtown Manhattan asset with Henry Crown and Company, will use proceeds from the loan with its 2029 maturity date to pay off a previous 20-year loan for Rockefeller Center securitized in the GSMS 2005-ROCK CMBS deal. Rockefeller Center was 93 percent leased at the time of the deal, with national tenants that include J.P. Morgan Chase, Deloitte, Lazard, Christie’s and Simon & Schuster.

One Beverly Hills

$2 billion construction loan

Cain International obtained a $2 billion debt package in March to finance construction of its 17.5-acre One Beverly Hills development that will include two luxury residential towers and a 10-story all-suite hotel. J.P. Morgan Chase headed up the deal with a $500 million senior loan. The other lenders were not disclosed.

“This endorsement [from J.P. Morgan] further strengthens our confidence in the stability and potential of luxury real estate in sought-after locations,” Cain International CEO Jonathan Goldstein told CO when the debt package closed in March.

50 West 66th Street

$1.2 billion refinancing

Gary Barnett’s Extell Development scored a $1.2 billion debt package in July from JVP Management to refinance 50 West 66th Street, a 69-story, 127-unit condo building it is developing east of Lincoln Center on Manhattan’s Upper West Side.

JVP Management previously supplied a $207 million mezzanine loan in 2022 to supplement $800 million of construction financing from Bank OZK. Bank OZK assigned JVP at least $840 million of construction debt in the new transaction.

Boca Raton Resort & Club

$1 billion refinancing

DFO Management (formerly MSD Capital), the family office of computer tycoon Michael Dell, nabbed a $1 billion CMBS loan led by Citigroup in August to refinance the Boca Raton Resort & Club. The two-year floating-rate, interest-only loan helped DFO pay down existing debt on the 1,047-room South Florida hospitality property it acquired in 2019 for $875 million and obtain new equity.

As CO reported back in August, DFO has already spent about $278 million revamping the club, and has plans to spend another $102 million to make improvements.

80 Clarkson Street

$985 million construction loan

Cale Street Partners and Farallon Capital Management closed a $985 million construction loan for Atlas Capital Group to build two luxury condo towers at 80 Clarkson Street in Manhattan’s Hudson Square neighborhood. Atlas is developing the project with joint venture partners Zeckendorf Development and Baupost Group.

The $1.25 billion project, just next to Google’s St. John’s Terminal, will include 101 condos and 175 affordable senior housing units — not included in this financing package — that will be ready in 2027.

425 Park Avenue

$911 million refinancing

L&L Holding Company sealed a $911 million loan from Sumitomo Mitsui Trust Bank to refinance its newly opened Midtown East office tower at 425 Park Avenue, which is anchored by Ken Griffin’s investment juggernaut Citadel. Loan proceeds were used to retire $911 million of previous debt provided by Blackstone in 2021 that funded final construction and lease-up of the 47-story skyscraper.

Its completion marked Park Avenue’s first full-block office development in more than a half century.

Fashion Show Mall

$850 million refinancing

The $850 million five-year, interest-only CMBS loan originated in October refinanced the Brookfield-owned Fashion Show Mall, a 1.9 million-square-foot retail asset in Las Vegas. Brookrunners for the LV Trust 2024-SHOW deal were Goldman Sachs, Wells Fargo, Citigroup and J.P. Morgan Chase. The mall’s collateral involved in the loan was 98.9 percent leased to more than 200 tenants as of July 2024, according to KBRA.

One Liberty Plaza

$750 million refinancing

Brookfield Properties, which bought out Blackstone’s 49 percent stake in One Liberty Plaza in Downtown Manhattan last year, secured a $750 million loan in June from Morgan Stanley to refinance the 54-story office tower.

Morgan Stanley previously supplied Brookfield with $783.9 million to refinance the 2.3 million-square-foot property in August 2017 after it sold a 49 percent stake in the building’s ownership to Blackstone that year when it was valued at $1.55 billion. Brookfield repurchased that same stake in 2023 with a $500 million loss in the property’s valuation.

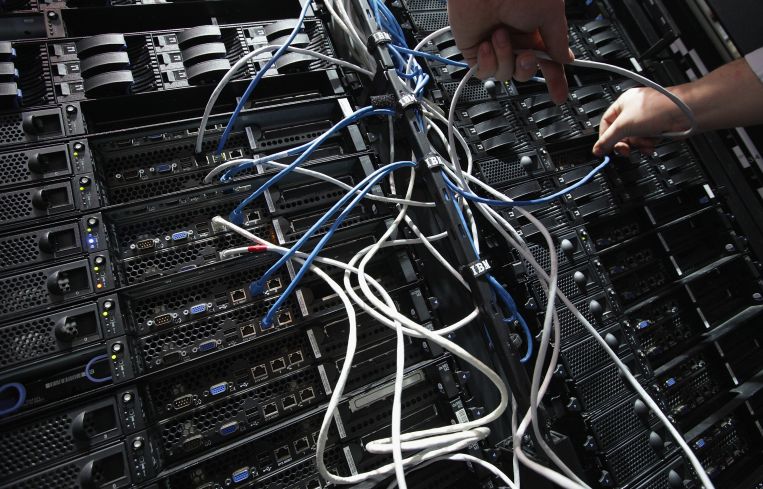

DFW1

$687.1 million refinancing

Data center developer CyrusOne secured a $687.1 million CMBS loan in July to refinance its DFW1 data center development in the Dallas-Fort Worth region. The 2024-DFW1 deal was led by Morgan Stanley, with Wells Fargo, Goldman Sachs and KKR also participating in the securitization.

When the deal closed, it brought CyrusOne’s capital raised to a dizzying $12 billion for the year. “Today’s announcement is another example of our ability to access large amounts of capital and tap different markets through institutional demand,” CyrusOne CEO Eric Schwartz said in a statement quoted by Yahoo. “This transaction comes on the heels of our $1.175 billion ABS issuance and CyrusOne securing $9.7 billion in new debt capital to fund data center growth.”

Waldorf Astoria Hotel & Residences Miami

$668 million construction loan

A PMG-led joint venture nabbed $668 million of construction financing in June from Bank OZK and Related Fund Management to complete its 100-story Waldorf Astoria Hotel & Residences Miami project. The financing for the 205-key hotel and 387-condo development set a record for the largest construction loan in South Florida history.

“PMG’s ability to secure financing for a project as significant and iconic as the Waldorf Astoria Hotel & Residences in today’s atmosphere once again underscores the confidence the capital markets have in our platform at large,” Dan Kaplan, managing partner at PMG, told CO when the deal closed in June.

277 Park Avenue

$650 million refinancing

The Stahl Organization refinanced its 1.9 million-square-foot office building at 277 Park Avenue in August with a $650 million CMBS loan. The five-year, fixed-rate debt package was led by Deutsche Bank in the COMM 2024-277 PBPR transaction.

The property is 97 percent leased, marking an 8 percentage point improvement from a year earlier, according to Fitch Ratings. One of the building’s anchor tenants is M&T Bank, which signed a 93,000-square-feet lease in 2022.

A Few Other Notable Debt Deals in 2024

Cipriani Residences Miami

$600 million construction loan

Mast Capital sealed $600 million of construction financing in February to build an 80-story condo tower called Cipriani Residences Miami on a 2.8-acre site the developer purchased for $103 million in 2021 in the city’s financial district. The debt package included $350 million from Banco Inbursa and $250 million from Ascendant Capital Partners. It was at the time the largest construction loan in South Florida history before it got supplanted by the Waldorf Astoria deal in June.

Industrial infill portfolio

$570 million acquisition loan

EQT Exeter nabbed a $570 million acquisition loan from New York Life Real Estate Investors to purchase 64 infill industrial assets across the U.S. The deal marked one of the largest in 2024 by a life insurance company originated by a single lender.

830 Brickell Plaza

$565 million refinancing

Oko Group and Cain International landed a $565 million loan in July to refinance a newly completed 57-story office building at 830 Brickell Plaza. The financing from Tyko Capital paid off a previous construction loan on the 640,000-square-foot property and provided a marked boost for the office market. The building houses tenants such as Microsoft, Citadel, Santander Bank and law firm Sidley Austin.