Freddie Mac Lifts Agency Dealmaking Ban on Meridian Capital Group

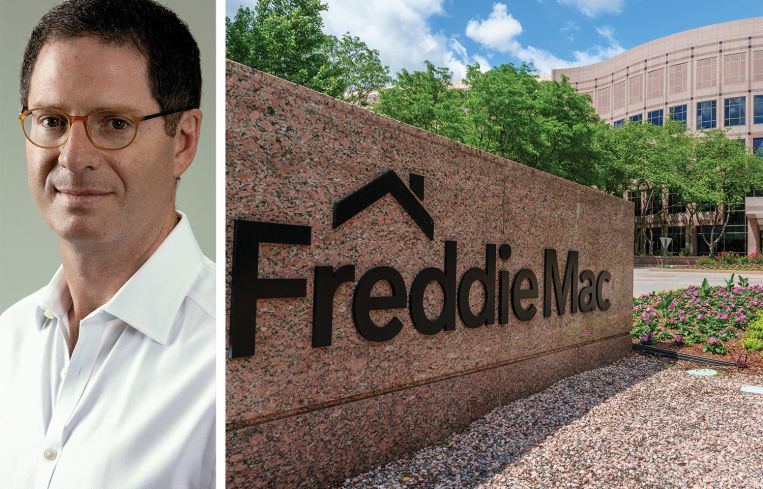

CEO Brian P. Brooks announced in a company memo that the brokerage can place deals through Freddie Mac beginning in January 2025

By Brian Pascus October 9, 2024 12:27 pm

reprints

Meridian Capital’s long timeout from Freddie Mac might finally be over.

Brian Brooks, CEO of the New York-based brokerage, announced in a company memo that in January Freddie Mac will lift a policy it placed on Meridian that banned the brokerage from placing deals through lenders that are Freddie Mac seller-servicers.

Freddie Mac had announced the penalty in November 2023 after it flagged the origination methods of a loan brokered on behalf of the government-sponsored entity. An investigation by Freddie immediately followed the announcement.

“Team, I have great news. We have been informed by Freddie Mac that they are lifting the pause on Meridian business for deals that close starting in January,” wrote Brooks. “I am over the moon with this good news — the future is brighter than ever for this great company.”

Brooks added that there will be “a special process” for any loan submissions to Freddie, and that Meridian brokers should wait for more guidelines before taking further action on those loans.

Freddie Mac confirmed the contents of the memo in an email to CO.

“The decision to consider loans submitted by our lenders that are brokered by Meridian Capital Group comes after a thorough review process and enhancements to our lender requirements,” said a Freddie Mac spokesperson. “We are continuing to closely monitor brokered loan activity to ensure our requirements are being followed.”

Sources close to the decision told CO that there are additional conditions lenders must abide by if they wish to bring a Meridian-brokered loan to Freddie Mac. These include: lenders will be required to repurchase a Meridian brokered loan if it defaults in first 12 months; if there is undiscovered fraud, or if fraud is discovered after the 12-month period, the lender would still be required to repurchase the loan; and additional due diligence requirements are now in place for loans brokered by Meridian, specifically regarding inspections and lease audits.

The Promote first reported the news of the memo on X.

The news marks a dramatic denouement to one of the more surprising sagas in national commercial real estate. Prior to its suspension by Freddie Mac, Meridian had been one of the premier commercial mortgage brokerages in the United States, largely due to its enormous portfolio of agency multifamily originations. During the seven-year period ending in 2022, Meridian arranged more Freddie Mac and Fannie Mae loans than any other brokerage in the nation.

Last year CO reported that one source suggested Meridian originated Freddie Mac loans outside of the agency’s underwriting standards. Another source said that tweaking, or manipulating, loan information to conform with underwriting criteria might have been exposed amid the high interest rate period of 2023.

Regardless, the agency lending pause initiated major changes inside Meridian this year.

In March, former CEO Ralph Herzka, who started the brokerage in 1991, was replaced by Brooks, a former acting controller of the currency and general counsel at Fannie Mae.

CO reported in April that Meridian debt capital specialists Adam Hakim and James Murad had bolted Meridian for Ripco Real Estate. Days later, another top broker, Tal Savariego, left Meridian to join Rob Verrone’s Iron Hound Management, a top CRE workout firm.

In June, longtime Meridian broker Judah Hammer also departed for CBRE after 19 years with the firm.

In August, CO reported that Ronnie Levine, who served as a senior managing director at Meridian Capital Group since 2005, left Meridian to begin Green Pine Real Estate, a CRE private equity firm that he co-founded with Seth Grossman, a former managing director at Meridian.

Levine and Grossman were joined one month later by Yoni Goodman, who was president of Meridian Capital Group for six years and with the firm for more than a decade.

With new leadership in place, and Freddie Mac back in the fold, it seems like Meridian will chart a new path forward in 2025.

Brian Pascus can be reached at bpascus@commercialobserver.com