Equity Residential Buys Apartment Portfolio From Blackstone for $964M

By Isabelle Durso August 7, 2024 12:39 pm

reprints

Equity Residential has purchased a portfolio of apartment buildings from Blackstone for roughly $964 million.

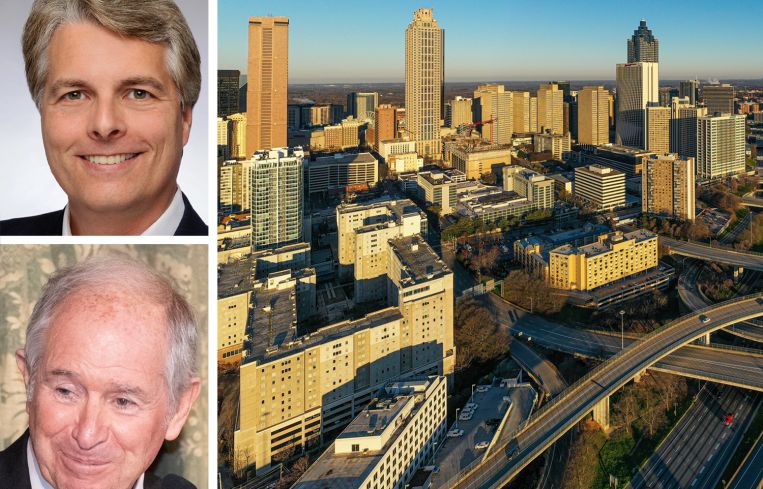

Equity will acquire 11 of Blackstone’s properties in Atlanta, Denver and the Dallas-Fort Worth area totaling 3,572 apartment units, according to Blackstone. The separate deals are expected to close in the third quarter of 2024.

“This transaction represents an excellent outcome for our investors and demonstrates the strong institutional demand for high quality assets,” Asim Hamid, senior managing director at Blackstone, said in a statement.

“Rental housing remains one of our highest-conviction themes, and we continue to see strong fundamentals in attractive markets,” Hamid added. “We’re pleased to have worked with Equity on this transaction, who will be an excellent steward of these properties going forward.”

Equity, a national multifamily giant headquartered in Chicago, owns or invests in about 300 properties across major U.S. cities, including New York, Washington and San Francisco.

Equity CFO Alexander Brackenridge said in a statement that the new transaction with Blackstone “is a significant step” in the company’s goal of “generating a higher percentage of our annual net operating income from these strong growth expansion markets.”

Things were looking up for Equity last week, when they posted positive earnings per share and strong revenue numbers in the second quarter of 2024 — just one year after the death of founder Sam Zell.

But commercial property owners have struggled amid the high interest rate environment. However, with anticipation of the Federal Reserve cutting its benchmark interest rate, deals are picking up. Earlier this year, Blackstone agreed to buy Apartment Income REIT for $10 billion.

The latest deal with Equity will help Blackstone generate proceeds to return cash to investors, the Wall Street Journal reported.

Isabelle Durso can be reached at idurso@commercialobserver.com.