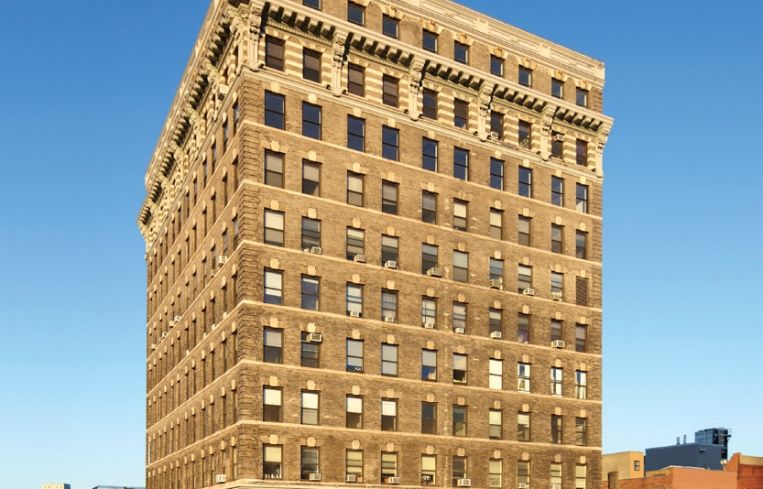

Savanna Hands Back the Keys to Harlem’s Lee Building

The real estate investment firm heads down a well-trodden path

By Abigail Nehring December 19, 2023 6:34 pm

reprints

Investment management firm Savanna handed a 12-story office building in Harlem over to its lender to avoid foreclosure.

TPG Real Estate Finance took the keys to 1825 Park Avenue, also known as the Lee Building, on Dec. 15 in a property transfer valued at $56.2 million. The transfer appeared in property records Monday and was first reported by The Real Deal.

A source with knowledge of the deal said it was a “deed-in-lieu” — a cheaper, and usually much faster, alternative to foreclosure. Savanna’s loan from TPG “is no longer outstanding,” the source said.

Spokespeople for TPG and Savanna declined to comment.

Savanna bought the Park Avenue building from Harlem’s “Mayor of 125th Street,” Eugene Giscombe, in 2015 for $48 million, property records show. TPG provided $45 million in financing for the purchase at the time and Savanna refinanced the loan for $54 million in 2019.

The property was listed for sale in 2021 for $75 million, as TRD previously reported, but a buyer never materialized.

Despite Savanna signing some 730,000 square feet of leases in 2022, the deal with TPG is a sign of the firm’s vulnerability. And it isn’t alone.

Increasing office vacancy has hit landlords hard, and up to 44 percent of office loans carry a balance that’s higher than the property’s value, according to a National Bureau of Economic Research study. In February, Brookfield defaulted on $784 million in loans tied to the Gas Company Tower and 777 Tower in Los Angeles.

In some cases, office developers have managed to renegotiate the terms of their loans. GFP Real Estate won a three-year year extension after defaulting on a $130 million CMBS loan it took out against 515 Madison Avenue, Commercial Observer reported in March.

In other cases, borrowers handed over their assets as a last resort before facing foreclosure. In May, RXR offered up 61 Broadway in the Financial District after defaulting on $240 million in debt tied to the property.

Abigail Nehring can be reached at anehring@commercialobserver.com.