Presented By: Ease Capital

Closing the Technology Gap in Multifamily Credit

By Ease Capital December 30, 2025 7:39 am

reprints

Memo Sanchez and Ryan Simonetti are the co-founders of Ease Capital, a technology-driven real estate lender and asset manager focused on multifamily financing. Simonetti brings deep CRE lending experience from his time at Gramercy Capital, while Sanchez’s background spans real estate data and product technology with co-founder roles at Reonomy and Pragmic.

They founded Ease in early 2022 to modernize how multifamily lending works. Backed by decades of experience across real estate credit, data science and structured finance, the Ease team has built modern infrastructure for a fragmented market — bringing institutional rigor, greater transparency and more predictable execution to multifamily lending.

Commercial Observer: What do you think has been happening in the multifamily sector, and where does Ease Capital fit in?

Ryan Simonetti: Over the past year, we’ve seen a growing structural gap in the $5 million to $35 million segment of the multifamily credit market given the broader pullback in regional bank and agency lending. While 97 percent of every multifamily loan outstanding today is less than $35 million, most private lenders focus on larger loans because it takes the same amount of time, effort and cost to originate and asset-manage those as it does smaller loans. With asset management fees compressing and labor costs rising, originating smaller balance loans has become increasingly challenging for most traditional lenders and alternative asset managers.

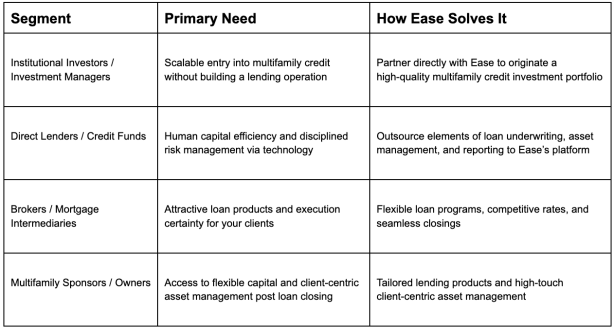

That gap is exactly where Ease Capital operates. We focus on supporting the fragmented middle-market and lower-middle-market multifamily credit ecosystem — delivering borrowers the financing they need while providing investment managers access to high-quality, diversified portfolios of multifamily credit investments at scale. Instead of trying to build the technology and direct lending capability in-house, alternative asset managers can partner directly with Ease to streamline the parts of the business that are costly, manual and difficult to scale: origination, underwriting, asset management, loan servicing, reporting and compliance.

What’s the opportunity in Multifamily as we head into 2026?

RS: Across the multifamily lending ecosystem — direct lenders, investment managers, brokers, and borrowers — most players still haven’t fully caught up to the previous wave of technological advancement. As a result, they’re now finding it even harder to incorporate today’s AI capabilities into their systems, processes and workflows.

Investment managers want to expand into the direct lending space but face high barriers to entry without building teams and digital infrastructure from scratch.

Direct lenders spend excessive time on manual underwriting, asset management, compliance and servicing, which slows execution, drives up costs and increases risk.

Borrowers and brokers, meanwhile, contend with inconsistent execution, opaque underwriting processes, and poor customer service after loan closing. That’s why we’re excited to share that Ease Capital is now offering our technology platform, proprietary data, in-house origination team, and asset-management capabilities as a lending platform-as-a-service — a trusted partner that supports the entire loan lifecycle, from origination through due diligence, closing, and ongoing asset management.

What does “platform-as-a-service” mean for multifamily lending?

Memo Sanchez: We think about platforms like the way Rocket, Affirm and Stripe work. They created one platform that brings their whole ecosystem together — customers, capital partners, suppliers — and make the experience seamless for everyone involved.

Ease is doing the same for multifamily lending. We’re building a single platform that connects brokers, borrowers, asset managers and all the downstream stakeholders, supporting the full life cycle of a multifamily loan. The goal is to speed up deal cycles, make underwriting decisions more transparent, and eliminate the friction that slows capital flow within the multifamily sector today.

On the origination side, the platform enables nationwide sourcing of multifamily opportunities that align with institutional credit boxes and risk profiles. Real-time analysis of sponsor, asset and market data ensures that only qualified transactions move forward, while streamlined broker engagement and full pipeline visibility simplify early-stage deal evaluation and accelerate term sheet execution.

Underwriting is handled end to end through automated data ingestion and AI-supported analysis of rent rolls, T-12s, comparables, and market intelligence. Credit decisions are consistent and defensible, mapped directly to each capital partner’s predefined underwriting standards. Integrated scenario modeling, sensitivity analysis and valuation tools are embedded directly into the sizing and underwriting workflow, allowing teams to move faster without sacrificing rigor.

Asset management is centralized across loans and borrowers, improving quarterly reporting and enabling proactive portfolio oversight. Automated covenant monitoring, DSCR and occupancy alerts, and exception reporting support Ease’s experienced asset management team. Loans are continually re-underwritten using updated property-level data, rent and expense comparables, and market-specific trends, while sponsor performance and exposure are tracked across geographies and credit strategies.

Looking ahead, Ease plans to extend the platform with AI-assisted buy-box matching, using real-time scoring models to improve speed, consistency and early risk detection for capital partners. Additional planned capabilities include automation for KYC/AML workflows and regulatory reporting as well as expansion into full loan servicing — covering payments, escrows, draw requests, and remittance reporting — while strengthening capital markets connectivity through seamless distribution to balance-sheet lenders, credit funds, insurers, and securitization partners.

Learn more about Ease or contact them at easecapital.com