D.C. Office Market Held Steady Ahead of Shutdown Despite Federal Downsizing Trend

Leasing volume hit nearly 2 million square feet, even as office-using job growth dipped to early 2021 levels

By Nick Trombola October 6, 2025 2:55 pm

reprints

For all the fuss about the Trump administration’s moves to cut the size of the federal government, the third quarter of this year was not as harsh on Washington, D.C.’s office market as expected.

The District’s office fundamentals remained steady between July and September, according to a recent market analysis by Savills, with average availability staying unchanged at 23.4 percent. Though still blisteringly high, that average rate is 100 basis points lower than the third quarter of 2024. Leasing volume was 1.8 million square feet.

That rise in activity drove higher average asking rents quarter-over-quarter, particularly for Class A space, with so few projects in the development pipeline. Average rent rose by 3.9 percent to $56.95 per square foot, according to Savills, while Class A rent jumped by 5.4 percent to $61.29 per square foot.

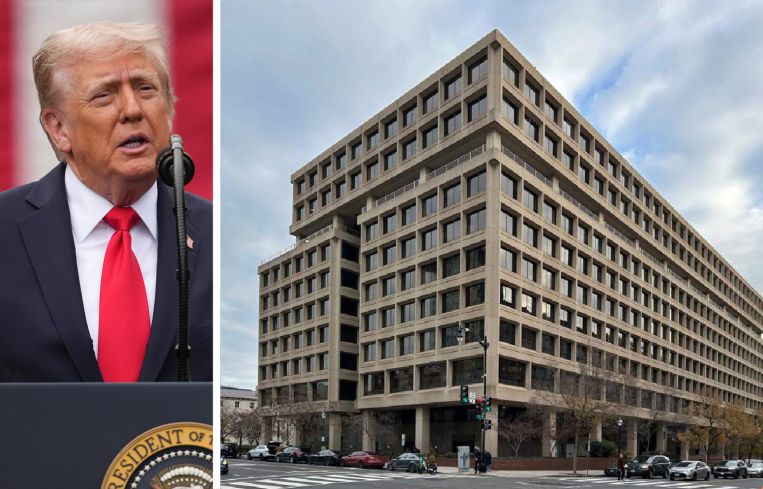

The federal government is still behind much of the activity, despite its overarching goal of diminishing its office footprint. The largest lease of the quarter, by far, was the Justice Department’s 477,473-square-foot extension at The Georgetown Company’s 450 Fifth Street NW. Georgetown had planned to convert the 11-story, Brutalist building into 500 residential units, though the government’s lease extension delays those aims by at least two years. The DOJ’s 403,000-square-foot renewal at Northwestern Mutual’s 145 N Street NE likewise led the previous quarter’s leaderboard, though it was a 30 percent downsize.

The Alcohol and Tobacco Tax and Trade Bureau and Civilian Board of Contract Appeals also inked roughly 50,000-square-foot renewals apiece.

However, the federal office downsizing, particularly from the so-called Department of Government Efficiency, has taken a toll. Federal cuts and space consolidations have driven the District’s office-using employment to its lowest level since early 2021, according to Savills.

Law firm flight-to-quality is still the D.C. office market’s saving grace. More than half of law firm leases above 20,000 square feet in the third quarter were relocations, per Savills, a trend since early 2024. Keller & Heckman inked the sector’s largest lease, relocating to 57,186 square feet at PIMCO and Manulife Investment Management’s 1100 New York Avenue NW. Fellow firm Manatt, Phelps & Phillips came in at a close second, inking 55,000 square feet at Skanska’s 1700 M Street NW.

Nick Trombola can be reached at ntrombola@commercialobserver.com.