CMBS Distress Rates Decrease Slightly in Q3

As we move into the final quarter of 2025, commercial real estate investors and commercial mortgage-backed securities (CMBS) stakeholders are closely monitoring delinquency and distress signals amid a backdrop of moderating interest rates and economic stabilization.

At CRED iQ, our latest data reveals persistent challenges in certain sectors, balanced by signs of resilience elsewhere. This update draws on our comprehensive delinquency, specially serviced and overall distress rates, alongside key market metrics from sources like the CRE Finance Council (CREFC) to provide actionable insights for navigating this evolving landscape.

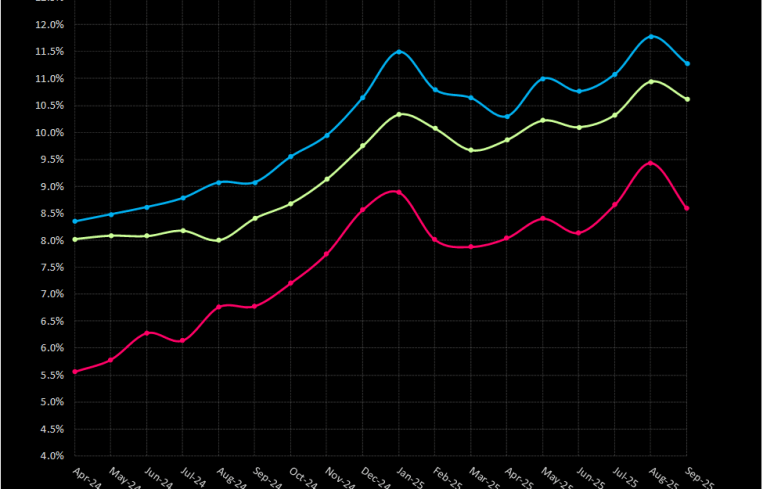

Starting with CMBS delinquency trends, our tracking shows a slight downward trend in overall distress as of September. Delinquency rates stood at 8.59 percent, down from 9.44 percent in August, while specially serviced loans declined to 10.63 percent from 10.95 percent. The combined delinquent and/or specially serviced rate reached 11.28 percent, marking a modest decrease from 11.78 percent the prior month.

Looking back, this metric has hovered between 10 and 12 percent throughout 2025, a stark contrast to the sub-5 percent levels seen in 2022 and 2023. For instance, in January 2025, the combined rate was 11.5 percent, peaking at 11.78 percent in August before this slight easing. Office properties continue to drive much of this distress, with broader implications for portfolio risk management.

Drilling deeper into property-type specifics from recent CREFC metrics as of August 2025, CMBS delinquency rates underscore sectoral divergences. Office loans remain the most pressured followed by multifamily. Retail and hotel sectors improved in September, while industrial properties, buoyed by e-commerce, maintained the lowest delinquency rate.

Beyond distress, broader market metrics paint a picture of cautious optimism. Treasury yields have stabilized, with the 10-Year at 4.18 percent as of late September, up from 3.8 percent a year prior but down from recent highs. The Federal Reserve’s rate cuts — now in the 4 to 4.25 percent bounds — have eased borrowing costs, potentially supporting refinancing amid $957 billion in CRE maturities for 2025, led by banks with $450 billion and CMBS/CRE collateralized loan obligations (CLOs) with $230 billion in maturities.

Cap rates tracked by CRED iQ edged higher nationally to 6.4 percent from 6.3 percent a year ago, with retail at 7.1 percent and office at 7 percent, while the Consumer Price Index (CPI) grew 0.9 percent year-over-year, indicating modest price appreciation.

Issuance volumes are showing bright spots with year-to-date private-label CMBS hitting $91.4 billion as of September, up 26 percent year-over-year, driven by single-asset, single-

borrower loans ($66.9 billion). Agency CMBS surged 39 percent to $105.7 billion, with Fannie Mae and Freddie Mac leading the way. CRE CLOs exploded 234 percent to $22.7 billion, reflecting investor appetite for yield. Lending shares shifted, with agencies at 20 percent in the first half of 2025 (down from 25 percent in 2024), while debt funds/real estate investment trusts rose to 14 percent. Total CRE debt outstanding reached $6.2 trillion, dominated by banks (49 percent).

Economic indicators bolster this view as CPI cooled to 2.9 percent year-over-year, with unemployment at 4.3 percent.

For investors, these trends suggest selective opportunities in industrial and multifamily, but vigilance on office exposure. At CRED iQ, we recommend stress-testing portfolios against upcoming maturities and monitoring special servicing transfers closely. As rates potentially ease further following the October Federal Open Market Committee meeting, refinancing windows may widen, but distress resolution will be key to 2026 stability.

Mike Haas is the founder and CEO of CRED iQ.