Goldman Sachs Lends $53M for Acquisition of Energy Firm’s Boston-Area HQ

By Andrew Coen September 24, 2025 12:17 pm

reprints

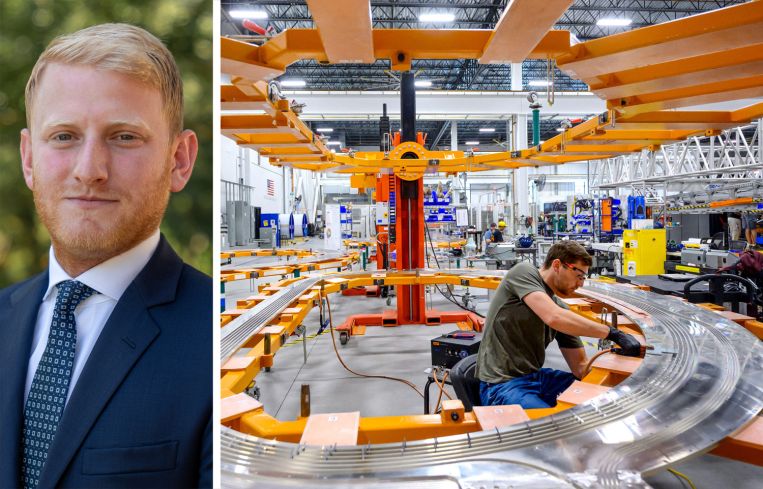

A joint venture between Pivotal Manufacturing Partners and Declaration Partners has landed $52.8 million of acquisition financing for the purchase of energy company Commonwealth Fusion Systems’ (CFS) global headquarters northwest of Boston.

Goldman Sachs supplied the loan for the sponsorship’s $74 million acquisition of the new 165,000-square-foot facility situated on a 47-acre research campus in Devens, Mass., that King Street Properties and The Baupost Group developed for CFS in 2022. CFS, which was founded out of the Massachusetts Institute of Technology in 2018, now has the backing of investors such as Google, Nvidia, Temasek and Mitsubishi.

The Real Reporter first reported the financing and purchase.

Pivotal, a real estate investment platform focused on industrial assets, will manage the facility 44 miles northwest of Boston in partnership with Declaration, which has financing backing from the family office of David Rubenstein, founder of private equity giant Carlyle Group.

David Robbins, managing partner at Pivotal Manufacturing, said the deal is part of the firm’s goal of scaling its platform with more advanced manufacturing assets targeting industries “critical” to supply chain security.

“We are confident in the strategic value of this real estate — an asset benefiting from significant, market-leading existing infrastructure and heavy power access,” Robbins said in a statement. “As artificial intelligence and robotics continue to penetrate industrial supply chains, driving new requirements for infrastructure, we are excited to own and operate this trophy real estate asset with specifications tailored to this next generation industrial renaissance.”

David Rabin, a partner at Declaration, said in a statement the acquisition represents a “best-in-class building with an attractive long-term lease profile and a well-capitalized tenant.”

Goldman Sachs did not immediately return a request for comment.

Andrew Coen can be reached at acoen@commercialobserver.com.