Wells Fargo Supplies $120M CMBS Loan to Refi Vornado’s 4 Union Square South

By Andrew Coen August 13, 2025 3:27 pm

reprints

Wells Fargo has once again stepped up to refinance Vornado Realty Trust‘s retail asset at 4 Union Square South with a $120 million commercial mortgage-backed securities (CMBS) loan, Commercial Observer has learned.

Vornado announced the 10-year, interest-only refinance yesterday, but didn’t include the lender’s identity.

The investment bank supplied the debt for the 204,000-square-foot property seven years after originating another $120 million refi for the former department store building Vornado redeveloped in 2005, sources familiar with the financing told CO.

The 2018 transaction, which was scheduled to mature in August 2025, had retired debt from a $120 million loan Wells Fargo closed in 2012. The prior loan carried an interest rate at the Secured Overnight Financing Rate, plus 1.50 percent (5.85 percent) as of Aug. 11, according to Vornado, while the new debt has a fixed rate of 5.64 percent.

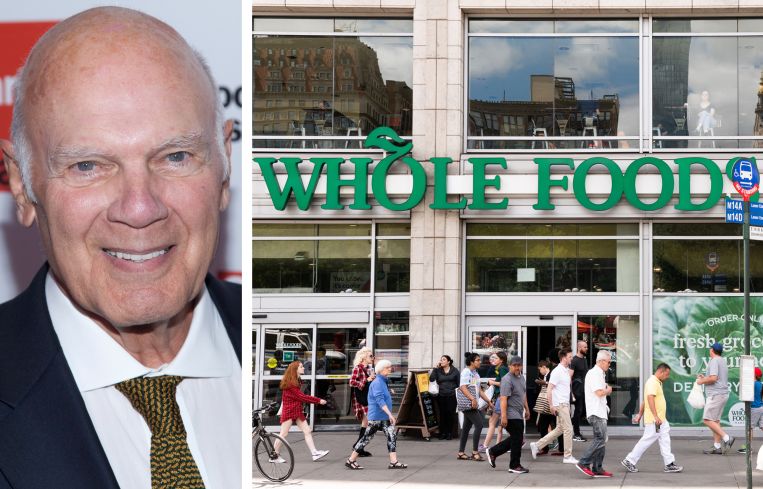

The 4 Union Square South building previously held a department store before Vornado transformed the property into a multi-tenant shopping center development 20 years ago. It features New York City’s first Whole Foods Market alongside tenants Burlington Coat Factory and DSW.

Wells Fargo declined to comment.

The 4 Union Square South deal was announced by Vornado nearly a month after the real estate investment trust landed $450 million of CMBS debt to refinance its Penn 11 Midtown Manhattan office property.

Andrew Coen can be reached at acoen@commercialobserver.com