SL Green, ESRT, Blackstone Eye Potential Paramount Group Sale

By Isabelle Durso August 28, 2025 1:57 pm

reprints

Some high-profile bidders are vying to acquire a major office owner in New York City.

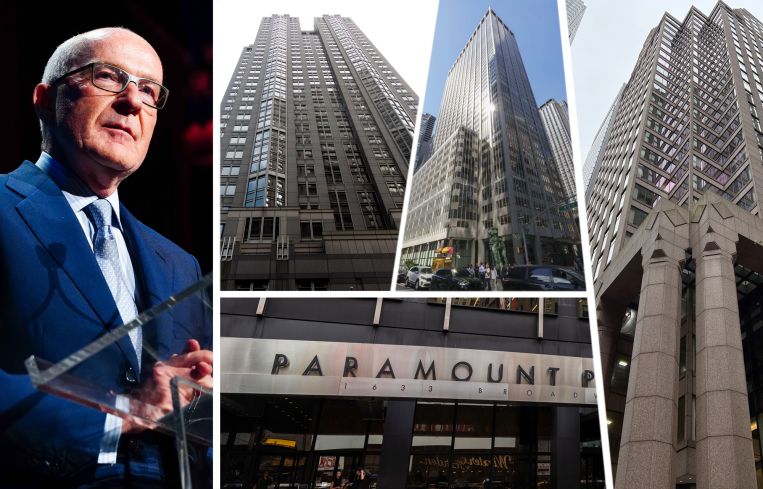

Paramount Group, which owns or manages 13.8 million square feet across its portfolio, announced in May that it was “exploring strategic alternatives for its business,” which could mean a direct sale of the company, the Wall Street Journal reported at the time. Paramount said it has hired Bank of America as its financial adviser for the deal.

The real estate investment trust (REIT), which owns major New York City office buildings such as 1301 Avenue of the Americas and 900 Third Avenue, has now reached the second round of bidding in the sale process, The Real Deal reported.

Among the bidders looking to acquire the REIT are SL Green Realty, Empire State Realty Trust, Blackstone, Rithm Capital and partners DivcoWest and Saray Capital, according to TRD.

TRD also reported that Vornado Realty Trust was among the potential bidders, but sources told Commercial Observer that Vornado has not provided any information on the deal.

Vornado, DivcoWest and Blackstone declined to comment, while spokespeople for Paramount, SL Green, ESRT, Rithm and Saray did not immediately respond to requests for comment.

News of the potential sale comes after Paramount previously declined two offers to acquire its business, including one from Monarch Alternative Capital for $12 per share in 2022, according to TRD.

The news also comes as Albert Behler, Paramount’s chairman and CEO, faces controversy regarding more than $4 million in undisclosed payments from the company for his personal and business interests over the past three years, TRD reported.

Then, earlier this month, Paramount announced it was under investigation by the U.S. Securities and Exchange Commission over conflicts of interest and compensation disclosures, according to the outlet.

Isabelle Durso can be reached at idurso@commercialobserver.com.