Sunday Summary: A Not-So-Savage Journey Into the Heart of ICSC

By The Editors May 25, 2025 6:00 am

reprints

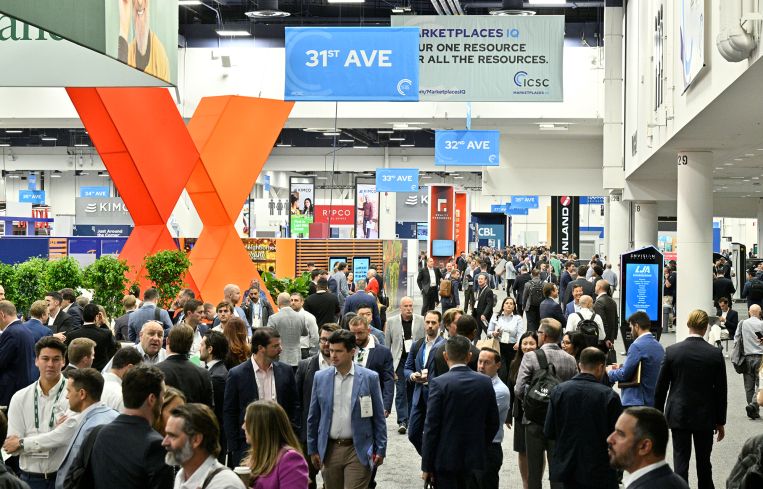

It’s May, so you know we’re not just celebrating Mother’s Day or Cinco de Mayo here at Commercial Observer. We’re also toasting the retail sector thanks to the annual ICSC convention in Las Vegas.

CO packed our briefcase (sans a serious drug collection, because we’re responsible citizens) and hit the convention floor to get to the heart of how the industry’s movers and shakers feel about the retail sector.

And, despite all the complications and uncertainty from things like tariffs and elevated interest rates, attendees felt retail was still the sector to beat.

“There’s always been demand for retail real estate, but the people who have wanted retail in the last 15 years are very experienced, very savvy, because it takes real expertise to own and operate multitenant retail,” JLL’s Kristin Mueller told CO. “And the investors that were sort of steering clear of risk stayed away from retail. Everybody’s back in now. Everybody wants it. And institutional investors that have quotas, goals to be invested in certain percentages in each of the property types, have all upped the percentage [of retail] that they want to own.”

Anybody with a long memory will know how that differs from the story about retail written five years ago, when there was some fear and loathing in the market. E-commerce surged during the pandemic, while shoppers remained largely confined to their homes, leading to many a think piece about physical retail’s death.

But those obituaries were a bit premature as retail came roaring back to life to become one of the best-performing asset classes in commercial real estate this year. And there’ve been two drivers of retail investment lately: high demand for spaces with few new ones under construction, and pent-up capital investors eager to deploy.

“We’ve seen more capital flow into retail today than we’ve probably seen since back into the early 2000s, pre-Global Financial Crisis,” Chris Angelone, co-leader of JLL’s national retail group, told CO at ICSC. “Everyone’s in on retail right now, and so we’ve seen this building, I’d say, over the past 24 months where … retail investors go from retail-curious to retail-serious … everyone’s looking for opportunities of scale, and there are more groups looking for opportunities of scale than there are opportunities of scale.”

CO also sat down with NewMark Merrill’s Sandy Sigal at ICSC to get his realistic take on the market and MCB Real Estate’s Gina Baker Chambers to talk about building retail where people live.

Back in the retail groove

If you needed an example to illustrate the turnaround of the retail market, you’d be hard-pressed to find a better one than SoHo.

The posh Manhattan shopping district was dealing with some troubles even before the pandemic, but they kicked into high gear after COVID-19 spread throughout the world. International tourism dried up overnight, causing more than 40 stores in the neighborhood to close by October 2021 and leading to the highest retail vacancy rate in Manhattan. The New York Times said that it was “perhaps” the commercial district hit the hardest by the pandemic.

Things have changed. The neighborhood was the site of an intense bidding war between Ralph Lauren and LVMH for a storefront at 109 Prince Street, with Ralph Lauren eventually winning the privilege of dropping $132 million to keep its longtime SoHo store. So, CO went behind the scenes this week to learn about the battle and how it tells the story of what’s happening in retail at the moment.

“The numbers are far above what anyone thought it could command,” retail broker Christopher Owles of Sinvin said about the Ralph Lauren purchase. “Most places in SoHo are still a steal compared to the uptown buildings.”

It isn’t just well-heeled clothing brands trying to set up shop in wealthier retail corridors, as cannabis dispensaries in the city have been leasing storefronts on posh streets like Fifth and Madison avenues.

Many of these operators have been trying to bring a more luxury vibe to the “devil’s lettuce,” but has that made leasing space any easier? (The short answer’s a “maybe.”)

“If I could find an address that was seemingly eligible or [the broker] found an address that was seemingly eligible, it got put in a pot, went through all the due diligence, and then we can start the journey of putting in a letter of intent that got rejected nine out of 10 times,” said Arish Halani, CEO of Herbwell Cannabis, which recently opened a store at 519 Madison Avenue.

It’s not just cannabis stores having trouble in the retail market. The space has been dealing with the impacts of President Trump’s “Liberation Day” tariffs, while many brands have filed for bankruptcy, setting some investors on the hunt for bright spots in the sector to deploy capital. One such spot is grocery-anchored retail, which has continued to perform and prove a sound investment.

Alright we get it, you love retail. Anything else happen last week?

There was plenty of other stuff to write about that didn’t involve shopping bags. How about some billion-dollar deals?

The week kicked off with news that Scott Rechler’s RXR signed a letter of intent to buy 590 Madison Avenue from the State Teachers Retirement System of Ohio for nearly $1.1 billion, one of the largest price tags for an office building since the pandemic.

RXR had plenty of competition for the building, as Tishman Speyer, Blackstone, SL Green Realty and RFR Holding were all reportedly in the running to pick up the price tag. And, while the large ask gave some bidders pause, with sources telling CO earlier this month the deal could be structured as an installment sale to make it an easier pill to swallow, RXR offered to buy the entire building outright.

And the phrase “Everything’s Bigger in Texas” held true as a joint venture between Blue Owl Capital, Crusoe and Primary Digital Infrastructure sealed a $7.1 billion construction financing from a consortium led by J.P. Morgan Chase for the second phase of their 1.2-gigawatt artificial intelligence data center in Abilene, Texas, leased to Oracle.

That deal closed four months after J.P. Morgan supplied $2.3 billion in construction financing for the initial 206-megawatt phase of the development at the Lancium Clean Campus.

Meanwhile, Trinity Investment sold the 950-room JW Marriott Phoenix Desert Ridge Resort & Spa to Ryman Hospitality Properties for $865 million; Longacre Group picked up a 34-building multifamily portfolio in the Bronx from Related Fund Management for $192.5 million; while Empire Capital Holdings is set to drop $130 million for a pair of office buildings on Park Avenue South in Manhattan.

Do Androids dream of being late to the office?

We’ve already seen the impact of artificial intelligence on the data center market, but it’s not just confined to there.

Well-capitalized AI startups have helped bring San Francisco’s post-COVID office market back from the brink, and they don’t seem to be stopping anytime soon.

A new analysis from CBRE showed that after leasing more than 5 million square feet in San Francisco over the last five years, AI-driven firms are expected to take an additional 16 million square feet between now and 2030 — or roughly 2.7 million square feet annually. That could help reduce its sky-high office vacancy rate from the 35.8 percent it kicked off 2025 with to less than 18 percent.

“Most of these AI companies are in the office four, five or six days of the week, and, like the mobile and app economy companies pre-pandemic, will have an impact and draw more people to the office on a regular basis,” said Colin Yasukochi, executive director of CBRE’s Tech Insights Center. “This will create more of an office culture and bring more people into Downtown.”

And it’s not just office. AI firms are also here for the retail revival we wrote so much about above, with firms providing data aggregation and analysis to help retailers decide whether to open a location in a certain spot or investors choose whether to pump money into a particular asset.

On a personal note, this is possibly the last time this humble, anonymous editor pitches in to write Sunday Summary (99 percent of the time, you’re in the capable hands of CO Editor in Chief Max Gross. But every so often I’ve pitched in and thrown some very loud music recommendations into your real estate coverage — like so.) Hope you had a laugh, it’s been fun.