Presented By: Diald AI

Speaker Spotlight: Steven Song of Diald AI

Steven Song, CEO of Diald AI, will be a featured speaker at Commercial Observer’s National Finance Forum at the Metropolitan Club in New York on May 6, 2025.

Artificial intelligence is primed to upend the way we do business, but much of it is still discussed around hypothetical scenarios. However, Diald AI is already making an impact. Tell us where you see the greatest opportunity in terms of streamlining the formation of real estate strategies (such as site selection and underwriting)?

The biggest myth is that AI in commercial real estate is still “coming soon.” At Diald, it’s already here.

We have identified an opportunity to reinvent and streamline the way real estate investors, lenders and developers identify, analyze and close transactions. Our platform helps these decision makers operate faster and better, and with far more context.

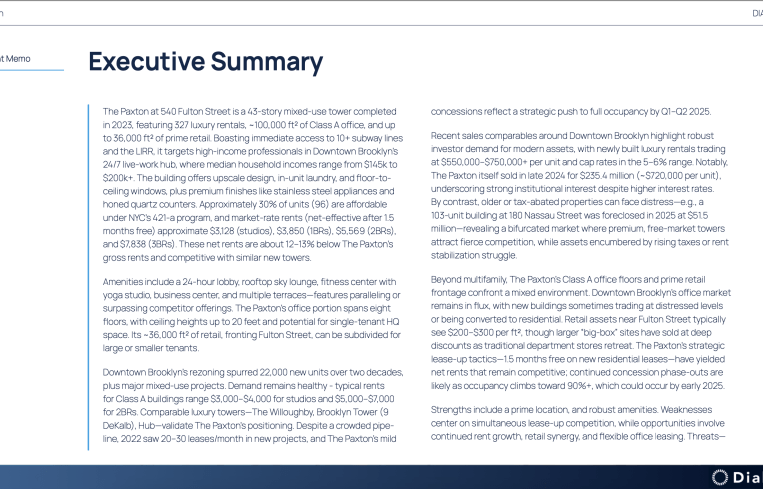

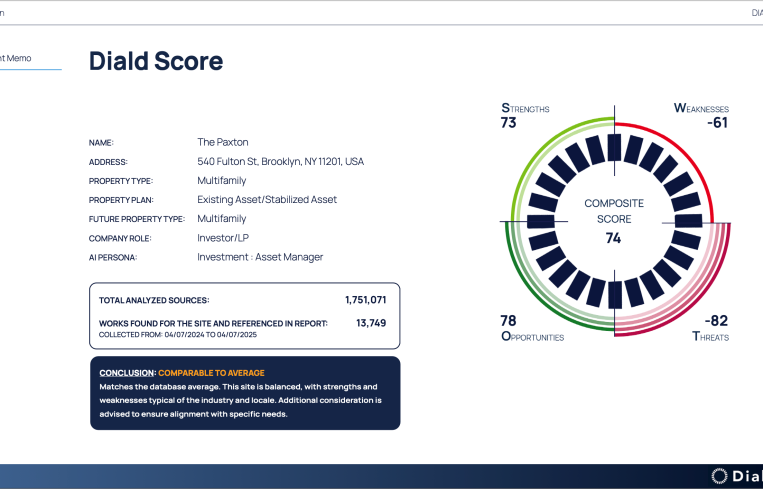

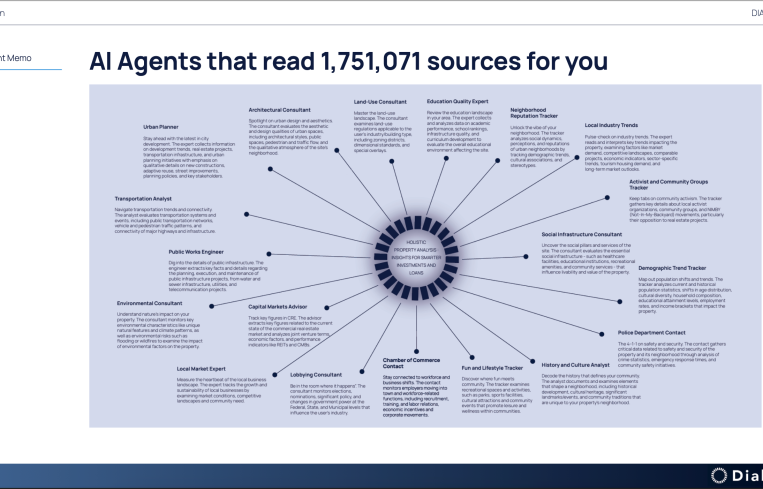

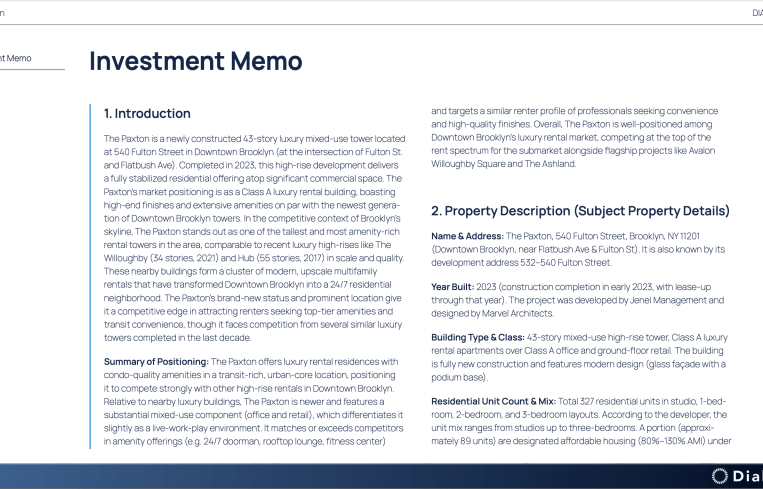

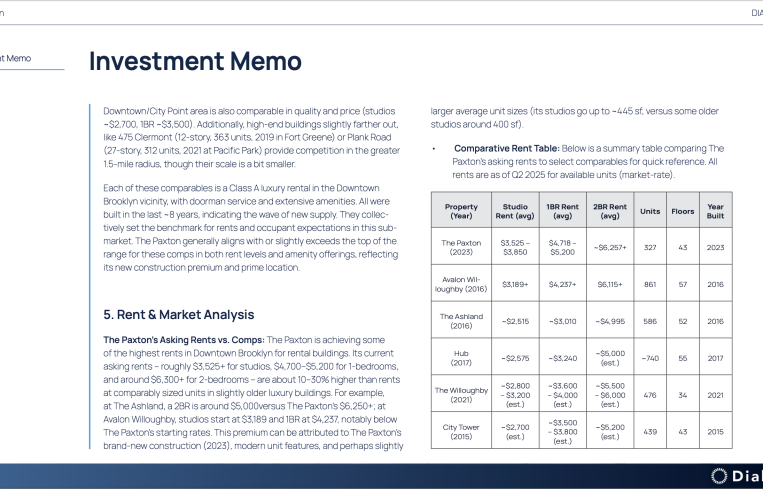

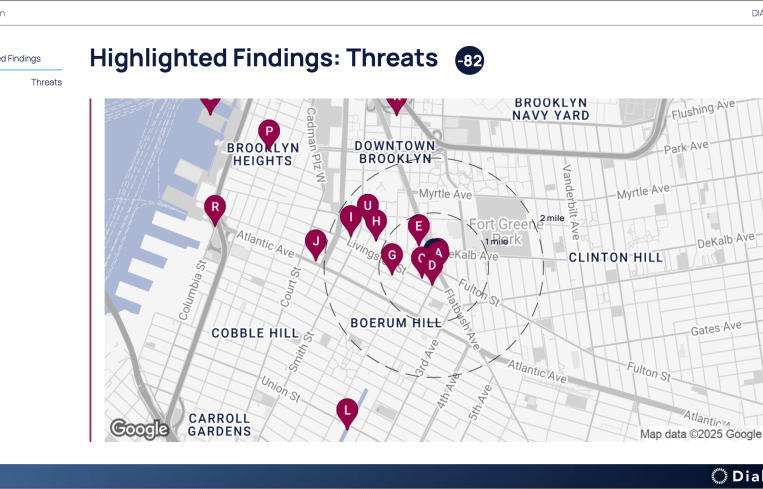

Diald uses a multi-agent, agentic AI system — 19 domain-trained bots — to generate full, comprehensive investment memos in a few hours. These memos include SWOT analysis, rent and sales comparables, zoning intelligence and neighborhood insights, as well as our proprietary Diald Score, which is benchmarked to a property or investment’s probability of success.

What used to take weeks, if not months, of fragmented, biased analysis can now take hours, and it’s consistent, scalable and grounded in quantitative and qualitative data from more than 1.7 million sources.

We feel like the processes of underwriting and due diligence leading to the closing of a real estate transaction is too arduous, and we aim to fix that. We’ve built a product that does the heavy lifting in underwriting: pulling inputs, surfacing risks, and even writing investment committee memos. And that is not theoretical — it’s operational.

How are your partners leveraging Diald to better forecast a property’s investment performance?

We assumed early adoption would come from small- and mid-sized shops needing scale and tools to keep up with bigger competitors who have more analytical power, because we see our product as a great equalizer. But it’s also been the big players — those who want to stay sharp in a volatile market — who’ve leaned in first.

Our partners use Diald in two main ways: one, to rapidly screen deals and widen the top of the deal funnel; two, to produce investment memos with sourcing, context and scoring already built in.

Users’ internal processes are accelerated by days or even weeks and their pipeline volume is significantly increased. We’ve seen pipelines double in velocity. Analysts go from chasing, cleaning and interpreting data to focusing on making better decisions. It’s also helping teams align faster; when you have a consistent, high-fidelity framework, there’s less friction in getting to “yes” or “no.”

We currently provide an actionable investment memo, but we will eventually be adding pro formas. We are already seeing opportunities in screening inbound broker emails, finalizing pro formas, writing up letters of interest, comparing and contrasting deals within the same pipelines, expediting the deal room due diligence process, and tweaking purchase and sale agreements and joint venture agreements.

And we also will be adding other geographical locations, building on our current model, which is operable in and applicable to the U.S. and Canada; we have plans to enter Japan, South Korea and the European Union this year.

How is Diald taking data analysis to the next level to give your partners the power of informed decision making?

Traditional real estate data platforms stop at simply supplying quantitative data points that real estate professionals are required to distill and analyze. Diald goes further: We tell you what the data means. We don’t just show you comps; we explain how your rents should be adjusted based on hyperlocal dynamics. We don’t just show you a neighborhood’s demographic trend; we tell you why that matters for your particular investment strategy. Everything is verbalized, and explained, much like a nuanced, human-made write up.

Our belief is simple: Real estate strategies have suffered from fragmented, biased, or incomplete analysis. Diald is the antidote. Our product is 10x faster, 10x cheaper and 100x more thorough than traditional analytical workflows — and we’re just getting started.

Diald was created to solve a problem. Oftentimes, before a real estate project is constructed, it could be underwritten upwards of 20 times, by various parties, because of a lack of trust in another’s assumptions.

We think our platform can help the industry get on the same page, provide some analytical uniformity and allow professionals to consistently identify the right projects to build, fund or lend against. Diald is a single source of truth to help get the best use out of projects and potentially avoid trouble that may come from inattentiveness or incomplete analysis.