No Fear and Loathing at ICSC Las Vegas

Even with volatile economic conditions in the air, ICSC Las Vegas was largely about recognizing retail’s current opportunities

By Nick Trombola May 22, 2025 12:51 pm

reprints

What happens in Vegas doesn’t always stay in Vegas.

Another year, another ICSC Las Vegas in the bag, and it was clear to many who attended real estate’s biggest conference that retail is the sector to beat amid these complicated and uncertain times.

The conference, held from Sunday through Tuesday, formally kicked off at the swanky Wynn hotel on the Las Vegas Strip, commencing with keynotes from jewelry mogul Kendra Scott and golfer-turned-entrepreneur Greg Norman. Panels addressed topics such as navigating uncertain economic conditions; SEO in the AI era; and mastering lease buyouts.

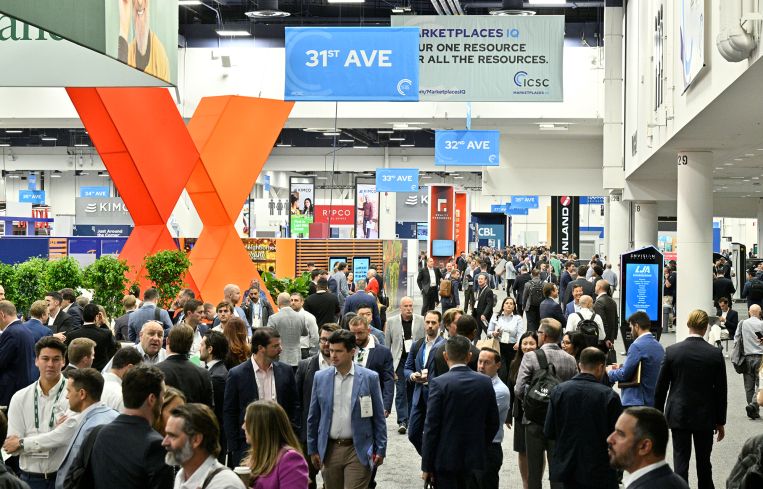

Monday was the main event. Tens of thousands of people flocked to the 4.6 million-square-foot Las Vegas Convention Center for a full day of networking, learning and deal-making. The energy surrounding retail’s potential this year was already palpable.

The fundamentals for U.S. retail real estate, for one thing, are solid — a sentiment echoed by brokers, developers, investors, finance experts, brand representatives and proptech creators at ICSC. Average vacancy at retail properties across the U.S. for the first quarter of 2025 was just 4.1 percent, according to a recent market report by JLL. A lack of substantial developments in the pipeline means that demand for space is high and will likely remain high for the foreseeable future. That demand has fueled continued rent growth, albeit at a slower pace compared to recent quarters, per JLL.

Even capital markets — gun-shy over the past few years due to elevated interest rates — have shown signs of life in 2025 despite a lack of relief from the Federal Reserve and chaotic economic realities. The $9.8 billion of investment volume in the year’s first quarter was a 13 and 12 percent boost over the same period in 2024 and 2023, respectively, according to JLL. Years of repressed capital deployments have made retail too tantalizing for investors to ignore.

The end result? Retail is currently outperforming all other commercial real estate sectors, JLL’s Kristin Mueller told Commercial Observer at her firm’s swarmed conference booth.

“There’s always been demand for retail real estate, but the people who have wanted retail in the last 15 years are very experienced, very savvy, because it takes real expertise to own and operate multitenant retail,” Mueller said. “And the investors that were sort of steering clear of risk stayed away from retail. Everybody’s back in now. Everybody wants it. And institutional investors that have quotas, goals to be invested in certain percentages in each of the property types, have all upped the percentage [of retail] that they want to own.”

It’s a different story entirely than the one written five years ago, during the throes of the pandemic. E-commerce surged as folks couldn’t leave their homes, and a cascade of think pieces effectively declared physical retail dead and buried.

But, of all the asset classes, retail has an indelible way of rising from the ashes. The introduction of department stores in the early 20th century; the creation of suburban malls in the 1950s and `60s; the rise of Walmart; the ripple effects of the Great Recession — all phenomena that didn’t kill retail, but changed it. Perhaps a broadening definition of what retail can be — food and beverage concepts, recreational sports facilities, even medical properties — is what helped the sector rebound after COVID-19, Christine Mastandrea, CEO of Whitestone REIT, told CO at ICSC. Or, perhaps those opportunities were there all along, flying under the radar.

“I think people missed it,” Mastandrea said. “When you think of product turnover and change, it’s the fastest in the food space. Well, when the Food Network came out, it made it cool and hip to come with creativity and explore [what food can be]. Something can be more than just a meal; it’s a work of art … that changed the restaurant business. And so it went from just being either local mom and pops, or your typical Chili’s restaurants, or whatever, and now it’s become a work of art, but also a place of community. To me, that’s been the most dynamic thing over the last 20 years.

“Another one that’s a huge one is fitness. I think people miss this too. It’s health and wellness, but that’s where people are, again, finding their community. So, yeah, the world’s changed a lot,” Mastandrea added. “But in some ways, maybe it’s been the same all along, and the malls and the power centers were just new products that weren’t time tested.”

One wrinkle in retail’s story that came up during ICSC — repeatedly — is President Donald Trump’s global tariff policies. Economic instability is a turnoff for both investment activity and tenant expansion plans, but many at ICSC suggested that the “wait and see” rhetoric from earlier this year is falling by the wayside.

“I think the press made too much out of it, to be honest,” Mastandrea said. “This is where you have to choose what noise to listen to. Gray hair [in the retail business] matters. Going through cycles and knowing what not to listen to [is important] … because there’s always going to be things that are going to stop you from doing things. I always say this is a business that’s not for the faint of heart, but when you’ve been through a number of cycles, you see how it rolls. You get more comfortable taking on risk, and then you also get better at managing your team.”

Others at the conference had more mixed perspectives regarding the tariffs and the risks they pose. Meghann Martindale, who leads retail market intelligence for Avison Young, said she’s seen retailers pause some expansion plans as economic conditions unfold. But investment activity, on the other hand, is moving full steam ahead, she said.

“On the investment sales side … we were stagnant the last three years,” Martindale said. “People had kicked the can through COVID, kicked the can through interest rates, and now we’re at a point where they’re not kicking the can anymore. They’ve kicked the can so many times that they’re at a point now where a lot of people aren’t going to have the opportunity to do that again. Or, they just thought conditions would be completely different by now, and they’re not, and now we have all these new volatility issues. So [they’re saying] ‘let’s just go.’”

Many thousands of ICSC attendees remained Tuesday, getting last-minute business or meetings on the books, even as workers began striking down their respective booths and handing out remainders of catered food. The conference hall officially closed at 3 p.m. that day, dispatching attendees back into the desert, and back into the retail sector’s promising, if uncertain, future.

Nick Trombola can be reached at ntrombola@commercialobserver.com.