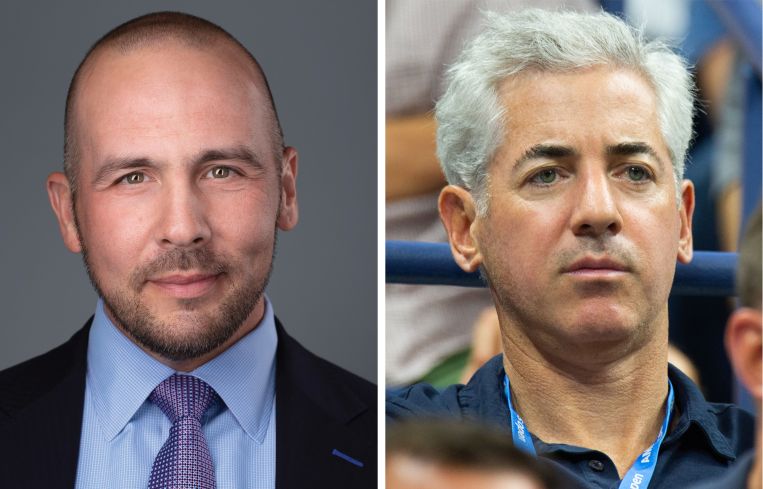

Howard Hughes Holdings Rejects Pershing Square Acquisition Bid

By Isabelle Durso March 3, 2025 12:25 pm

reprints

Howard Hughes Holdings (HHH) has rejected Pershing Square Capital Management’s latest bid to merge with the commercial real estate giant in a $900 million investment, HHH announced Monday.

After a few weeks of deliberation and careful public comments about the potential deal, HHH said Monday that Pershing Square CEO Bill Ackman’s proposal “is not acceptable in its current form,” according to the announcement.

In addition, HHH’s special committee has “entered into a standstill agreement with Pershing Square to facilitate further discussions to explore potential alternatives,” the announcement said.

That standstill agreement, which may not “result in any particular outcome,” will remain in effect until March 13, HHH said.

Pershing Square and HHH declined to comment, while a spokesperson for Morgan Stanley — which is acting as financial adviser to HHH’s special committee — did not immediately respond to a request for comment.

Ackman first floated a plan to acquire a majority stake of HHH in a $1.5 billion deal in January. Ackman then put forward a new deal last month to acquire 10 million newly issued HHH shares for $90 apiece, and fill HHH’s C-suite with Pershing Square executives, including Ackman becoming chairman and CEO of HHH.

While it remains to be seen whether the two firms will reach a deal, HHH reported strong earnings at the end of 2024, with a net income of $285.2 million and $862 million of completed financings, as CO previously reported.

Isabelle Durso can be reached at idurso@commercialobserver.com.