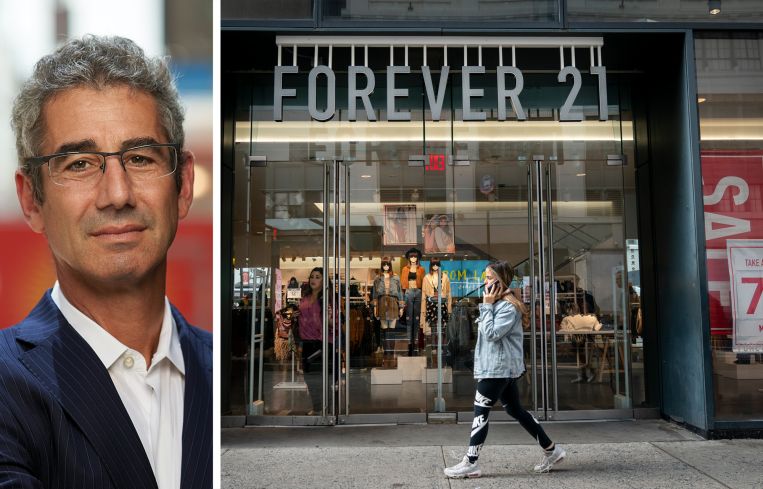

Forever 21’s Expansive Portfolio Hits the Market Amid Bankruptcy

More than 2.9 million square feet is available, including stores around the country, headquarters space in Downtown L.A., and distribution space in California's Inland Empire

By Greg Cornfield March 21, 2025 4:25 pm

reprints

Forever 21’s expansive real estate portfolio has hit the market after the sinking clothing retail brand filed for bankruptcy last weekend.

The full portfolio includes approximately 360 store leases across major U.S. markets totaling 7.6 million square feet, in addition to the company’s headquarters office and distribution warehouse space. Forever 21’s website and stores in the United States will remain open while it winds down its brick-and-mortar businesses and looks to sell some or all of its assets.

“While we have evaluated all options to best position the company for the future, we have been unable to find a sustainable path forward, given competition from foreign fast-fashion companies, which have been able to take advantage of the de minimis exemption to undercut our brand on pricing and margin, as well as rising costs, economic challenges impacting our core customers, and evolving consumer trends,” Brad Sell, chief financial officer at Forever 21, said in a statement. (The de minimis exemption allows imports under a certain value to enter the U.S. duty-free.)

Earlier this week, RCS Real Estate Advisors listed for sale fewer than 100 Forever 21 store leases around the county, amounting to more than 2 million square feet of retail space. The deals range from 4,000 square feet to the 153,500-square-foot store in Riverside, Calif. Eighteen of the retail leases for sale, spanning 666,846 square feet, are in California.

“These properties offer tremendous opportunities for retailers looking to expand their footprint in key shopping destinations,” Sell added.

RCS is also marketing the Forever 21 headquarters office lease in Downtown Los Angeles, where office vacancy is a dominating issue, as well as a notable distribution center lease in Southern California’s Inland Empire.

In June 2022, Forever 21 signed an office lease for almost 164,000 square feet at Brookfield’s California Market Center at 110 East Ninth Street in Downtown L.A. It costs $606,198 per month, and runs until March 2034.

The distribution center spans almost 657,000 square feet in Perris, one of the region’s industrial hubs. Monthly rent at the Prologis-owned property costs $338,774 per month, and the 10-year deal ends December 2029.

“We’re committed to helping Forever 21 maximize the value of these leases while providing retailers with access to premium locations at competitive lease terms,” said Spence Mehl, partner at RCS Real Estate Advisors. “With demand for high-traffic retail space remaining strong, this portfolio represents a significant opportunity for growth-minded brands.”

Forever 21 is owned by SPARC Group — a team made up of Brookfield, Simon Property Group and Authentic Brands — which acquired the clothing store company out of a previous bankruptcy in 2020.

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.