Strong Leasing Helps Vornado Beat Estimates in Q4

Steven Roth said that the work-from-home "scare" has ended as leasing picks up

By Amanda Schiavo February 11, 2025 2:03 pm

reprints

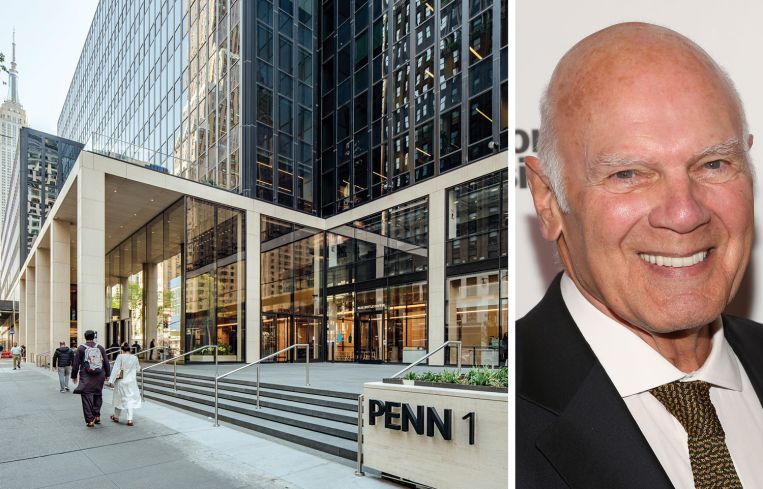

The work-from-home “scare” has ended, and that helped Vornado Realty Trust end 2024 with better-than-expected fourth-quarter earnings as it moves toward profitability, according to CEO Steven Roth.

Vornado posted a net income of $1.2 million in the fourth quarter, better than the net loss of $61 million reported for the same period in 2023. The firm had an increase of 1 cent per diluted share while analysts had been expecting a loss of 5 cents per share for the fourth quarter, according to Reuters.

Revenue for the period grew to $457.8 million versus $441.8 million for the same three-month period in 2023 and exceeded analysts’ expectations of $447.4 million, Reuters reported.

Part of that success was from the strong leasing activity Vornado saw throughout the year.

“Work from home was a scare. But as we predicted, it would not last,” Roth said during the company’s earnings call Tuesday. “Most [workers] have left their kitchen tables and are back at the office.”

Vornado leased 3.34 million square feet overall during 2024, with 2.65 million square feet of that being New York office leases. For all of 2023, Vornado leased 2.1 million square feet of office space and 299,000 square feet of retail space in New York.

“Business is healthy and robust,” Roth said. “Demand for space in New York is actually pretty terrific.”

Roth went on to discuss the success Vornado has had with its buildings in its Penn District, noting the completion of 285,000 square feet of deals at Penn One at starting rents of $98 per square foot. At Penn Two, Roth said Vornado is close to signing a 300,000-square-foot lease, but he did not provide further details on this deal.

“We are on the 2-yard line with a handful of important deals,” he continued. “We will finally complete the master lease to [New York University] at our 1.1 million-square-foot 770 Broadway by the end of the month.”

Roth said the NYU deal would relieve Vornado’s balance sheet of $700 million in debt on the asset. The firm is also close to refinancing its Times Square hotel and retail property at 1535 Broadway.

Amanda Schiavo can be reached at aschiavo@commercialobserver.com.