$36B in CRE Loan Mods Took Place Over the Past 3 Years

The CRED iQ research team zeroed in on loan modifications over the past three years, exploring trends and resolutions for commercial real estate securitized loans during this transformative period. This analysis included the loan modifications registered across commercial mortgage-backed securities (CMBS), single-borrower large loans (SBLL), CRE collateralized loan obligations (CLOs) and Freddie Mac loans.

Our research covered both actual monthly data and also a cumulative analysis to ensure we expose as many patterns and trends as possible. We looked at both loan counts as well as loan balances in our study.

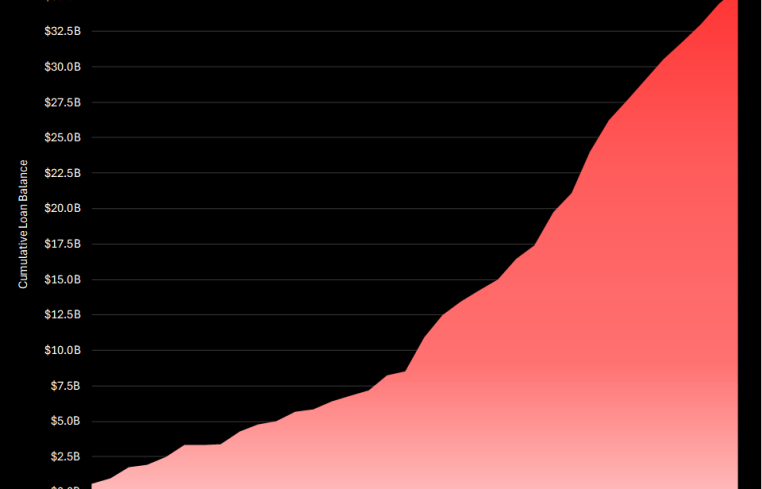

Our analysis reveals steep growth in modifications over the three-year range. We found 2,778 loans modified during the period with a cumulative loan balance of $35.5 billion.

Over the past three years, loan modifications showed a lumpy pattern but consistent overall growth. The modification filings varied from 52 properties in January 2022 ($584.1 billion in loan balances) down to just five properties in January 2023 ($157.5 million). Meanwhile, December saw the highest number of modified loans in 2024 (347 loans worth $1.1 billion in value) while April represented the largest loan value ($2.9 billion).

From a cumulative perspective, 2,778 loans worth $35.5 billion have been modified since January 2022.

A recent notable modification involved Energy Centre, a 757,275-square-foot office property in New Orleans’ French Quarter, that is backed by a $53.3 million loan that also has an additional $8.7 million in mezzanine debt. Imminent monetary default resulted in the loan being transferred to the special servicer in September 2023. At origination, the loan was scheduled to mature in October 2023. Special servicer commentary indicates the extension of the loan closed in October 2024, but an updated maturity is not listed.

The Energy Centre was appraised at $83.6 million ($114 per square foot) at origination in August 2013, which excluded the planned elevator and common area deferred maintenance renovation that was underway. The value of the asset increased to $92.6 million ($122 per square foot) in January 2024. The asset had a debt service coverage ratio of 1.75 as of December 2023 and was 86 percent occupied at the end of 2024.

Mike Haas is the founder and CEO of CRED iQ.