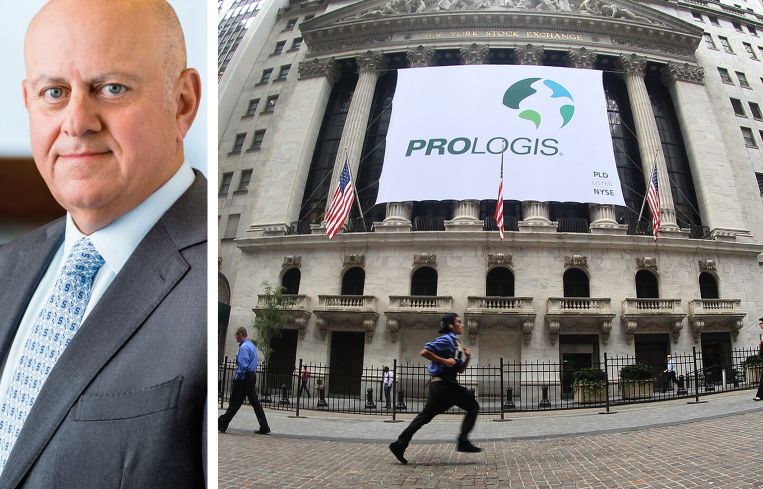

Prologis Persists Through Softened Industrial Market

Logistics-focused real estate investment trust beats analyst estimates for funds from operations

By Andrew Coen October 16, 2024 2:45 pm

reprints

Prologis exceeded analysts’ expectations in the third quarter while contending with a continued nationwide slowdown in the industrial sector.

The real estate investment trust (REIT), which is the largest owner of industrial space in the U.S., reported Wednesday funds from operations (FFO) of $1.43 per diluted share — an increase of 10 percent from the third quarter of 2023 and above analysts’ forecasts of $1.37 per diluted share.

“While occupancy and rent softened against the backdrop of positive-yet-subdued demand, we continue to deliver impressive net effective rent change due to the still powerful lease mark-to-market embedded in our portfolio, which bridges us through this soft patch to the next cycle of rent growth,” Tim Arndt, chief financial officer of Prologis, said during the REIT’s quarterly earnings call Wednesday.

The logistics giant posted third-quarter revenue of $1.9 billion, which was up from $1.78 billion a year ago and slightly off of analyst forecasts. Arndt said revenues were affected by roughly 35 basis points (bps) of “bad debt,” which is higher than its typical 15 to 25 bps range.

San Francisco-based Prologis achieved occupancy of 96.2 percent across its portfolio by the end of the quarter, which Arndt noted was nearly 300 basis points above market expectations. Rents decreased around 3 percent globally during the quarter, according to Arndt, and roughly half that amount when excluding its Southern California properties.

Chris Caton, managing director, global strategy and analytics at Prologis, said that despite experiencing rent declines in Southern California this year, the company is bullish on the region long term, due to having a growing economy with jobs up 3 percent since 2019 coupled with it becoming more of a gateway for international goods. Caton also stressed that land remains scarce around Los Angeles for industrial development, with new state restrictions under California Assembly Bill 98 creating more barriers for new projects.

“We think Southern California has a really bright outlook,” Caton said. “Customers are still working through spare capacity having taken more than they needed when vacancies were zero, but these long-term trends will be more important over time.”

Dan Letter, president of Prologis, said the company has so far exceeded its plans for data center developments in 2024. He said it has data centers completed or under construction this year that will produce 1.6 gigawatts of secure power. An additional 1.4 gigawatts will be generated from projects in “advanced stages” with another planned 1.5 gigawatts of projects submitted for applications across its global portfolio.

Andrew Coen can be reached at acoen@commercialobserver.com