Office Distress Hits New Peak, Up 156% in Last 18 Months

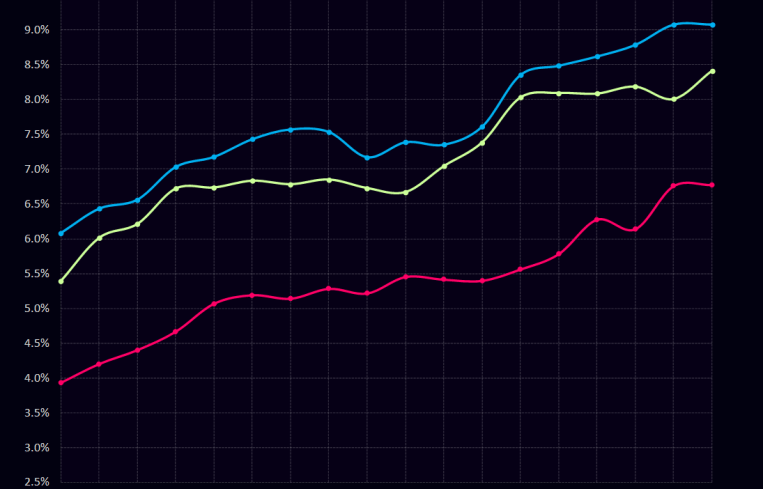

The overall CRED iQ distress rate remained at a record high 9.1 percent for a second straight month in September.

CRED iQ’s special servicing rate increased to 8.4 percent from 8 percent in September compared to August while the delinquency rate, consistent with the distress rate, came in flat at 6.8 percent. The most noteworthy change was office distress reaching a new peak of 14.8 percent, a 156 percent increase from 18 months ago when it was only 5.8 percent.

The CRED iQ team evaluated payment statuses reported for each loan securitized by commercial mortgage-backed securities (CMBS) financing, along with special servicing status, as part of our monthly distress update.

The office segment rose by 108 basis points month-over-month, which earns office the second-largest change this print and widens the office segment lead amongst all property types.

Multifamily slowed its distress rate growth, increasing to 11.2 percent from 11 percent in the August print. Nine months ago, that rate was 2.6 percent. The multifamily segment loses its second-place status to retail but the differences remain fractional.

After reducing its distress rate last month, retail added 98 basis points. At 11.4 percent, retail has the second-highest overall distress rate amongst all property types.

The hotel segment was up marginally, logging 8.6 percent of their properties in distress.

As reported in our Sept. 5 report, the industrial segment returned to its normal, sub-1 percent distress rate (0.6 percent) after resolving payment status issues associated with one large single-borrower large loan (SBLL) portfolio valued at $2.18 billion.

Meanwhile, self-storage saw a similar swing to 2.4 percent from 0.1 percent in our previous report. Increased distress in this sector is caused by a $356.5 million SBLL loan falling delinquent.

Payment status

Looking at distressed loan payment status, 18 percent of the loans are current. While 1.1 percent of loans are attributable to late (but in the grace period) and 6.5 percent of loans were late (but less than 30 days delinquent). Combining these three metrics, 25.6 percent of all loans were current, late within the grace period, or less than 30 days delinquent.

The nonperforming matured category increased from 30.9 percent to 42.3 percent in September with 90-plus days delinquent jumping from 10.9 percent to 12.8 percent. Performing matured loans rose from 16.2 percent in our August report to 14.5 percent in this print .

Office loan distress example

A $525 million loan backed by the Mobil Building, a 1.7 million-

square-foot, mixed-use property in Midtown Manhattan, failed to pay off at maturity in September. The interest-only loan includes a $175 million mezzanine loan, part of a total debt of $700 million. The loan transferred to the special servicer due to maturity default. Servicer commentary indicates discussions of a loan extension.

The collateral consists of office and retail space located on East 42nd Street in the Grand Central submarket. Built in 1954, the property was valued at $900 million ($527 a square foot) at underwriting in June 2014. The property was 89.2 percent occupied and most recently had a debt service coverage ratio (DSCR) of 1.39.

Self-storage loan distress example

The $356.5 million SBLL loan, backed by a portfolio of 29 self-storage properties, fell delinquent when it failed to pay off at its September 2024 maturity date. The portfolio consists of an aggregate of 24,076 units or 2.2 million square feet across 12 states. The collateral was valued at $541.7 million ($22,498 a unit) at contribution in April 2022. The portfolio had a DSCR of 0.98 and was 92.1 percent occupied.

The interest-only loan was added to the servicer’s watchlist in February 2024 due to delinquent taxes. The September servicer commentary indicates the borrower is seeking a short-term extension through mid-October to avoid purchasing another cap rate.

Mike Haas is the founder and CEO of CRED iQ.