L.A. Records Highest Level of Office Leasing Activity Since Early 2020: Report

Despite growing activity, office availability rates are still on the rise in the region

By Nick Trombola October 1, 2024 4:42 pm

reprints

Demand for office space in Los Angeles is not quite as back as John Wick, but new quarterly data indicates that the market may still have some sparks of life.

This summer, L.A. recorded its highest level of office leasing since the beginning of the COVID-19 pandemic, with 3.8 million square feet signed in the third quarter of 2024, according to Savills’ analysis released Tuesday. That figure represents a 27 percent boost in activity year-over-year, and nearly hits the 4 million square feet of activity recorded in the first quarter of 2020.

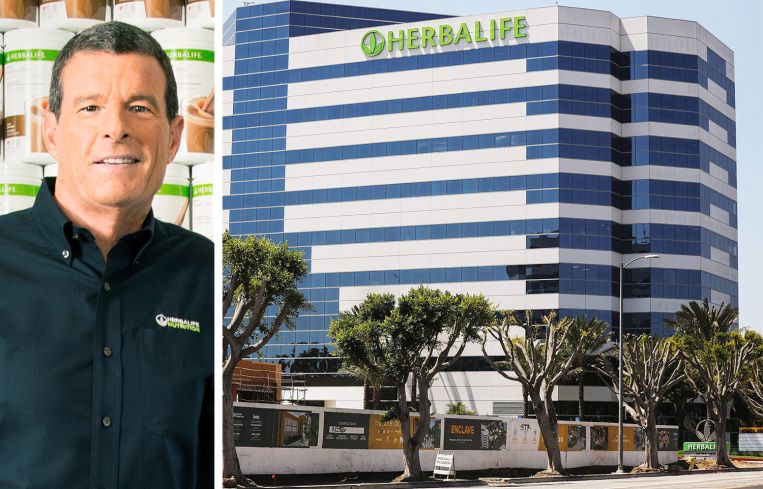

Most of that activity was driven by lease renewals or relocations. The largest came by way of the Southern California Gas Company’s 198,553-square-foot lease in early September, a downsize move from its namesake Gas Company Tower in Downtown L.A. and relocation to CIM Group’s City National 2CAL building just down the block. Another was wellness company Herbalife’s July 188,545-square-foot sale-leaseback of its office in L.A.’s South Bay to Rexford Industrial Realty.

J.P. Morgan Chase also signed a 162,713-square-foot renewal and expansion lease at 2029 Century Park East in Century City — the top office submarket in Southern California — according to the report. J.P Morgan and Hines own the building.

Despite that buzzing activity, availability rates in L.A. are still on the rise.

Availability jumped to 28.3 percent this past quarter, increasing by 90 basis points from the second quarter and 180 basis points year-over-year. The rise is driven by employers, particularly those in the tech sector, downsizing their office footprints in the region while overall demand remains muffled, per Savills.

Overall average monthly asking rents remained consistent at $3.90 per square foot, though asking rents for Class A offices rose 1.7 percent year-over-year as the flight-to-quality trends continued in Southern California.

Still, the report notes that the notable rise in leasing activity has ignited some cautious optimism that demand for office space is returning to L.A., even as office-using employment growth in the region, particularly in the tech and entertainment industries, has turned negative over the past year.

“Leasing activity will be very closely watched to see if the Los Angeles office market has turned the corner or if recovery is further away,” the report said.

Nick Trombola can be reached at ntrombola@commercialobserver.com.