Elliott Management Buying Miami Office Tower for $450M

By Julia Echikson September 26, 2024 2:09 pm

reprints

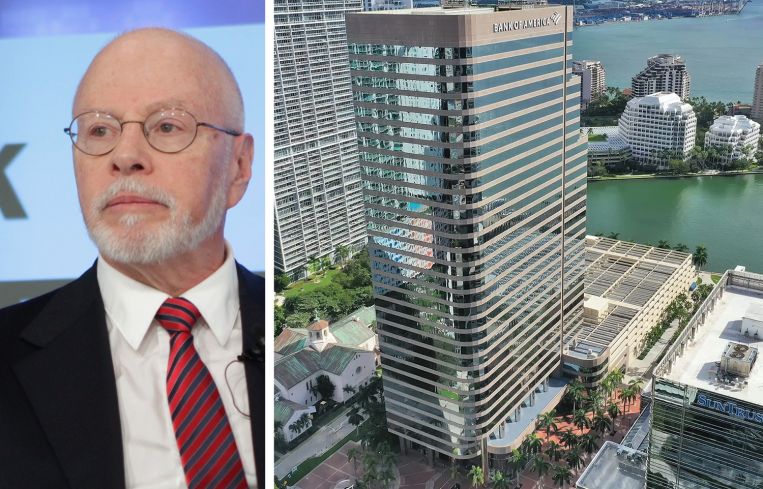

Paul Singer’s Elliott Management, a hedge fund known for its aggressive activist tactics, is diving deep into office real estate, going into contract for $450 million to buy an office tower in Miami’s financial district, Bloomberg reported.

The building, 701 Brickell, is home to some of the biggest names in finance, including Apollo Global Management, BlackRock and Point72 Asset Management. Last year, Pura Vida, a popular fast-casual chain, opened a 5,000-square-foot cafe on the ground floor.

In April, Nuveen Real Estate put 701 Brickell up for sale, seeking $500 million. JLL is brokering the sale of the 32-story high-rise. The New York-based investor purchased the 1.1 million-square-foot tower for $172 million in 2002, according to property records.

If the deal closes, it would mark Miami’s largest office sale this year. In 2023, Nuveen sold 801 Brickell, a nearby office property, for $250 million.

Elliott Management, which moved its headquarters from New York to West Palm Beach in 2020, has been making inroads in Miami real estate this year. The firm and Adi Chugh launched Tyko Capital, which has emerged as one of the city’s largest lenders in recent months, providing $565 million to refinance the 830 Brickell office building and $527 million to build the St. Regis-branded luxury condo complex, also in Brickell.

The district’s office asking rents — which average $93.73 per square foot, the highest in Miami-Dade County — have jumped since the pandemic hit, thanks to a slew of high-profile, new-to-market companies that set up shop. Asking rents also got a boost from the arrival of 830 Brickell, which is nearing completion and set a new benchmark for rates.

Representatives for Nuveen and Elliott Management did not immediately respond to requests for comment.

Julia Echikson can be reached at jechikson@commercialobserver.com.