Why Manhattan Office Leasing Went Gangbusters in July

Look first at what happened in Midtown — then at the lowest supply of sublease space in two-plus years

By Abigail Nehring August 6, 2024 7:00 am

reprints

Manhattan office landlords can congratulate themselves for their vim and vigor last month.

Leasing volume in Manhattan rose 58 percent in July to 3.87 million square feet from 2.45 million square feet signed the previous month, outpacing last July’s volume by 67 percent, according to a report by brokerage Colliers.

The nation’s largest office market even surpassed its pre-pandemic average in 2019, when Manhattan registered 3.58 million square feet of office deals per month.

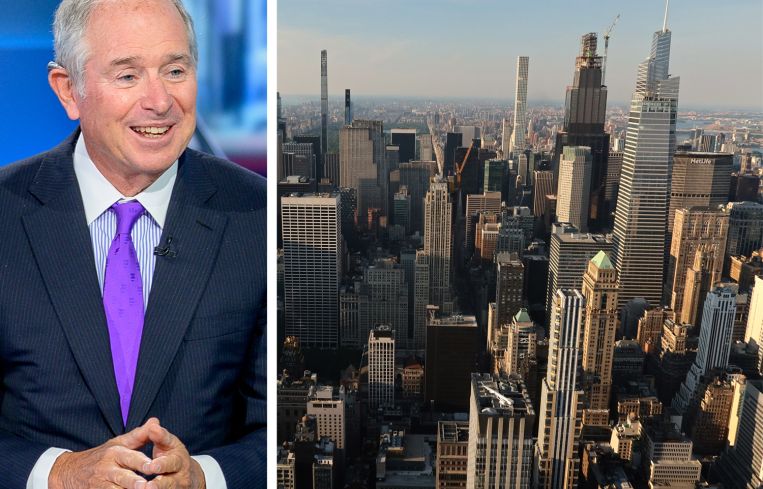

The new rosy figures are due in large part to Blackstone’s 1 million-square-foot deal at Rudin’s 345 Park Avenue, which accounts for about a quarter of the borough’s total leasing volume in July. The private equity giant signed the largest lease Manhattan has seen in the past five years, overtaking Bloomberg’s 946,815-square-foot renewal earlier this year at 731 Lexington Avenue.

But, even without Blackstone’s boost, the Midtown submarket is punching above its weight. Some 78 percent of last month’s leasing activity occurred in Midtown, with law firm Willkie Farr & Gallagher renewing for 315,000 square feet at 787 Seventh Avenue and investment firm Ares Management expanding to 307,336 square feet at 245 Park Avenue.

The office boom in Midtown South in the decade before the pandemic left Midtown on the sidelines, but now demand is creeping north again, according to Colliers.

Midtown is home to a plethora of the city’s trophy towers, and numerous value-play opportunities in the submarket are fueling its resurgence, according to Frank Wallach, executive managing director of research and business development at Colliers.

“Manhattan was really becoming a borderless market,” Wallach said. “You had millions of square feet of tenants migrating, mostly from Midtown out to other parts of the Manhattan market.”

But now the Mad Men-era glory is returning, and public transportation might be playing a role. Wallach cited the Long Island Railroad’s direct link with Grand Central Terminal as an example of a once-in-a-generation project that’s making Midtown that much more accessible.

“We know that over the last several years there’s been a population shift out to the suburbs,” Wallach said. “That all really works in Midtown’s favor.”

Average office asking rent across Manhattan meanwhile ticked up 0.1 percent in July to $74.30 per square foot, still lagging the borough’s average in March 2020 of $79.47 per square foot.

Asking rents are highest in Midtown South, where landlords are asking on average $80.18 per square foot. Downtown asking rents were virtually unchanged in July, averaging only $57.10 per square foot. In Midtown the average asking rent was $78.73 per square foot.

Overall availability tightened by 0.3 percentage points across Manhattan to 17.6 percent in July, down from 17.8 percent at the same time last year. And sublet availability also contracted last month by about 660,000 square feet to 19.78 million square feet on the market, the lowest level of sublease supply since April of 2022.

“You’re beginning to see the pendulum move in the other direction, but more so in some markets than others,” Wallach said. “There is still technically an oversupply of space, but over the last year or two, it’s really beginning to enter this new phase where availability has begun to tighten.”

Abigail Nehring can be reached at anehring@commercialobserver.com.