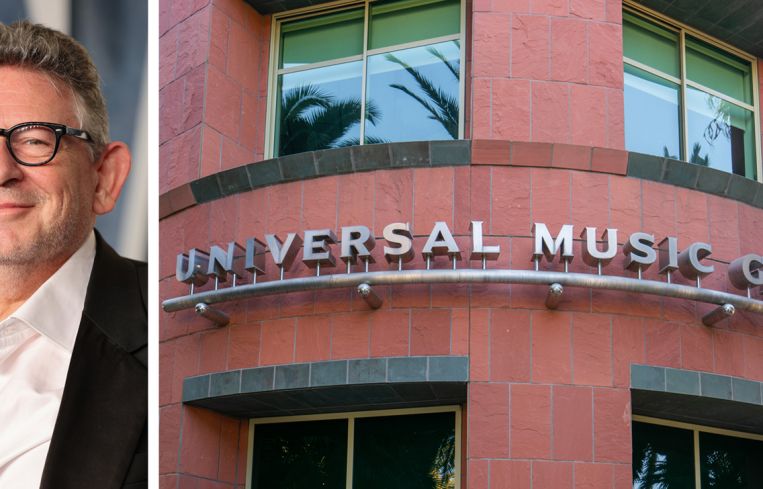

Universal Music Group’s 226K-SF Office Renewal Led L.A.’s Slow Q2

By Greg Cornfield July 1, 2024 4:20 pm

reprints

Office building distress in Los Angeles is expected to accelerate through the rest of 2024 as demand continues to recede and stubbornly high interest rates stay put, a new market report says.

Approximately 2.7 million square feet of office leasing activity closed in L.A. during the second quarter of 2024, which is about 18 percent less than the first quarter, according to a report released Monday by Savills. Pre-pandemic quarterly rates were regularly above 4 million square feet.

“Leasing activity continues to be mostly expiration-driven as occupiers remain highly focused on controlling costs,” the report states.

Of the top 10 leases signed in the past quarter, just one was for a new added location for the tenant, and it was a sublease deal. Although, three of the top 10 leases included expansions.

The average asking rent for Greater L.A. decreased from $3.94 per square foot per month last quarter to $3.90 per square foot at the end of the first half of the year. However, the average Class A asking rents rose by 7 cents to $4.10 per square foot per month.

“The Los Angeles office market remains bifurcated with some submarkets such as Century City seeing historically high asking and effective rent, while in softer markets such as Downtown L.A., effective rents have been decreasing due to higher landlord concessions,” Savills’ report read.

With interest rates expected to be higher for longer, more office landlords in L.A. are on track to default on loans and give properties to lenders in the second half of the year. That will put more negative pressure on leasing and result in more overall “flight to quality,” as well as “flight to capital” as tenants seek properties that aren’t burdened by debt problems, according to Savills’ report.

The bifurcation will also force more owners to determine their properties are no longer competitive, and lead them toward conversions or redevelopment alternatives, the report added.

The top five leases in the quarter were on the Westside, including three in Century City.

Universal Music Group signed a renewal deal for 225,773 square feet at 2220 Colorado Avenue in Santa Monica for the largest lease deal of the quarter. Latham & Watkins’ 98,761-square-foot deal at 10250 Constellation Boulevard in Century City was the second largest. FPM Development’s 94,081-square-foot sublease was third largest at 3101 West Exposition Boulevard in Culver City.

Other notable leases include (in order of size): law firm Sheppard Mullin’s 76,374-square-foot at 1901 Avenue of the Stars in Century City; law firm Paul Hastings’ 66,183-square-foot renewal and expansion at 1999 Avenue of the Stars in Century City; Union Bank’s 51,706-square-foot renewal at 800 North Brand Boulevard in Glendale; law firm Paul Weiss’ 49,404-square-foot renewal and expansion at 2029 Century Park East in Century City; and Skechers’ 47,498-square-foot renewal at 1240 Rosecrans Avenue in El Segundo.

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.