CRE Distress Rate Up 26 Basis Points in March

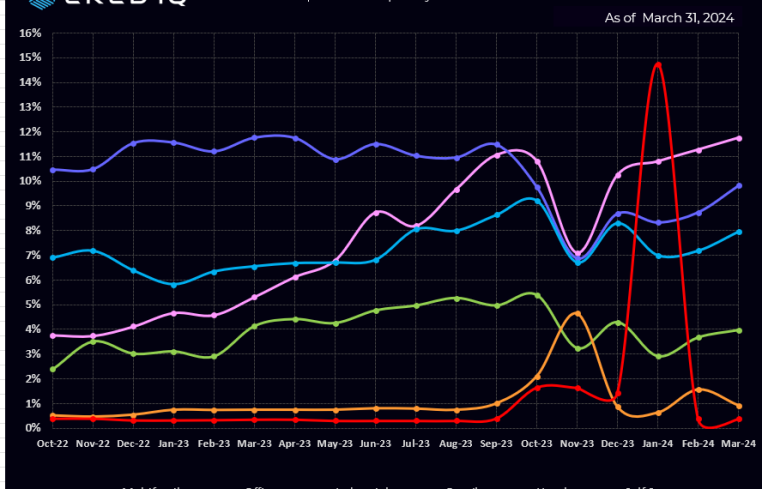

CRED iQ’s distress rate for all property types increased 26 basis points in March from 7.35 percent to 7.61 percent, an all-time high since we began tracking. This follows modest decreases in three of the last four months with a net reduction of 18 basis points during that period.

Retail’s distress rate earned the largest monthly increase with 108 basis points — the largest such increase in that sector since December 2023. A key factor was the $158 million loan backed by the Miami International Mall, which failed to pay off at its February 2024 maturity date. Servicer commentary indicates a forbearance agreement for one year through February 2025 was established. The 306,855-square-foot super-regional mall in the Miami International Airport submarket reported a 2.34 debt service coverage ratio (DSCR) for year-end 2023.

The hotel segment distress rate had the second-highest increase last month, jumping to 7.7 percent from 6.9 percent in February. Partially driving the increased hotel distress rate is the 164-room Hilton Garden Inn Cupertino limited-service hotel in the San Jose market, which is backed by a $32 million interest-only loan that transferred to the special servicer in March due to imminent monetary default prior to its December 2024 maturity date. The nine-month financials from September 2023 reported the hotel was performing at a 63.7 percent occupancy and a 1.27 DSCR.

The office sector notched its fourth consecutive distress rate increase and continued its status as the property type with the highest distress rate

Within the self-storage sector, as previously reported, the overall distress rate declined primarily due to a large self-storage portfolio ($2.1 billion) loan’s payment status becoming current in February. This explains the wild temporary swing in this normally low-distress property type.

Underlying CRED iQ’s distress rate, our specially serviced rate rose 34 basis points to 7.38 percent while the delinquent print shaved one basis point. More than a quarter of the distressed loans are nondelinquent with 21.1 percent current and 8 percent within the grace period or fewer than 30 days late.

A plurality of the distressed loans (37.1 percent) are past their maturity dates and have stopped making monthly payments. On the other side, 10.3 percent are past their maturity dates, but still make their monthly mortgage payments on time. Measuring delinquency during loan terms prior to maturity dates, CRED iQ calculated 23.6 percent of the distressed loans are reporting between 30 days to 120-plus days delinquent.

Mike Haas is the founder and CEO of CRED iQ.