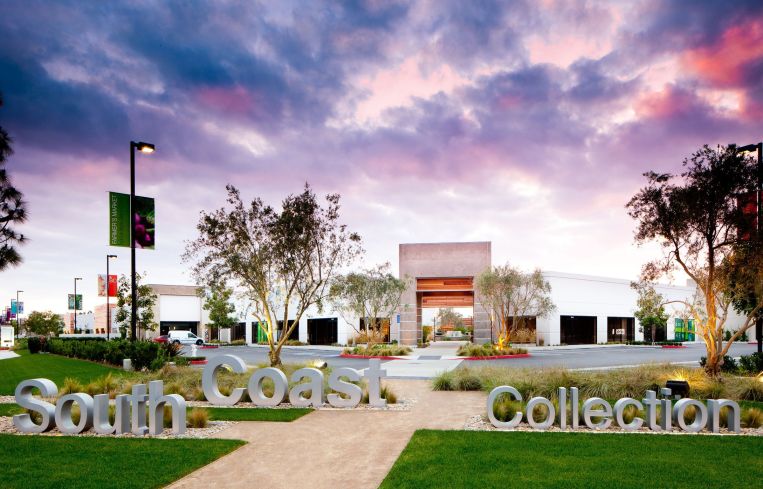

Continental Realty Buys Retail Center in SoCal for $110M

By Nick Trombola November 2, 2023 12:46 pm

reprints

Continental Realty has acquired another large retail space and its first in Southern California.

The Baltimore-based firm bought the complex known as South Coast (SoCo) Collection in Orange County, for $110 million. Eastdil Secured represented the seller, a joint venture between Burnham Ward Properties and Rockwood Capital, which acquired the asset for $120 million in November 2015, property records show.

The 292,000-square-foot property is at 3303 Hyland Avenue along Interstate 405 in Costa Mesa. It’s 97 percent leased with roughly 60 home-decor and fashion tenants, including Coco Republic, Design Within Reach and Natuzzi Italia.

SoCo is also home to The OC Mix, a 15,000-square-foot dining and shopping space with more than 20 restaurants, coffee shops and quick-service eateries.

“South Coast Collection is the only shopping venue of its kind in an extensive, high-net-worth trade area,” said Josh Dinstein, Continental Realty’s senior vice president of acquisitions. “The OC Mix, a highly successful food and dining concept serves dual purposes as an amenity and a high-volume traffic driver on its own. The asset’s institutional quality and strong value-add potential, plus its location in the heart of Orange County, make SoCo the perfect acquisition for our entry into the Southern California marketplace.”

Built in 2007 on 20 acres, the property is adjacent to the Vans headquarters and is near the corporate campus of defense contractor Anduril Industries.

Continental Realty financed the purchase through the Continental Realty Opportunistic Retail Fund 1 (CRORF), a closed-end fund for which $261 million has been raised since 2021. SoCo is the second property asset that Continental Realty purchased on behalf of CRORF this year, following its $78 million acquisition of Lakeside Village, a 460,000-square-foot shopping center in the Lakeland suburb of Tampa, Fla.

“Consumers have returned to traditional brick-and-mortar retail stores and restaurants as the growth of e-commerce has subsided and, by leveraging our extensive relationships and relentless market analysis, we are continuing to pursue additional shopping center opportunities on a national level,” Continental Realty CEO J.M. Schapiro said.

Continental Realty’s purchase of SoCo is only the eighth single-asset retail transaction in the U.S. worth more than $100 million this year, according to commercial real estate analysis firm Green Street Advisors. In comparison, 33 such transactions closed last year.

Nick Trombola can be reached at NTrombola@commercialobserver.com.