Dollar Volume of Brooklyn Investment Sales Down 50 Percent Annually

By Abigail Nehring November 13, 2023 7:19 pm

reprints

Real estate investment in Brooklyn is on track to return to Earth by the end of 2023, after reaching historic highs in 2022, according to a new report from brokerage TerraCRG.

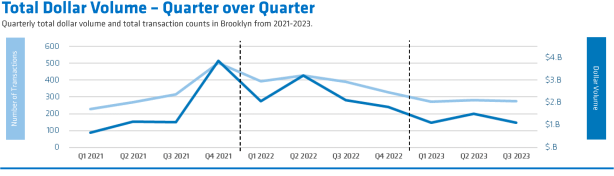

The total dollar volume of investment sales in the borough was down 50 percent at the end of September compared to the same time last year, according to the report. And it fell 27 percent quarter-over-quarter.

Some 274 investment properties changed hands in Brooklyn in the third quarter, totalling $1.1 billion in sales. That brings the total number of transactions so far this year to 834 — a 31 percent decline year-over-year.

But a little historical perspective helps, said TerraCRG’s Dan Marks.

“When I first started in this market a little over a decade ago, the entire Brooklyn commercial sales market for an entire year was $1 billion,” Marks said. “And this quarter was $1.1 billion dollars, so you know it’s really important to reflect on how far this market has come.”

Rising interest rates coupled with new rent-stabilization laws, rezonings and the end of the industrial boom all converged to put Kings County’s zenith in the rearview mirror, said Marks.

The office and industrial markets have seen the steepest declines this year, with the once red-hot industrial sector seeing a dollar volume drop of 73 percent year-over-year, dragging down the data across all asset classes, according to the report.

Rezonings in East New York and Gowanus, Brooklyn, have caused the city’s industrial footprint to shrink, and a few blockbuster sales made 2022 a top-heavy year for industrial sales in the borough, Marks said.

Last year saw the massive $330 million sale of an Amazon logistics center at 640 Columbia Street in Red Hook, blowing 2023’s largest industrial deal so far — the $28 million acquisition of 185 Van Dyke Street — out of the water.

In total, the borough saw 22 industrial sales that exceeded $10 million last year, but only four sales have met that threshold so far in 2023, Marks said.

Then again, there’s been a more modest decline of 9 percent in the number of sales year-over-year, much better than the office sector’s 13 percent drop in sales activity during that same time, which is cause for optimism, Marks said.

“I think that the 9 percent year-over-year drop in activity in that asset class is a better representation as to how that market is performing,” Marks said. “Of all the asset classes, it’s the smallest percentage drop year-over-year — in a year that is notably down across the board. I think that is a testament to the ongoing demand for industrial space in the Brooklyn market since starting in this market over a decade ago.”

Multifamily and mixed-use properties haven’t fared much better this year, with the dollar value of multifamily investment sales down 49 percent year-over-year and mixed-use down 60 percent.

The drop in sales is in part a reflection of the narrowing construction pipeline for multifamily development since the expiration of the state’s 421a affordable housing tax abatement in June 2022.

Without such incentives, Marks said the math just doesn’t work out for large rental projects.

The largest sale the borough saw in the third quarter was The Carlyle Group’s $97.5 million purchase of the multifamily property at 8 Marcy Avenue in Williamsburg over the summer. The runner-up was the $41.2 million sale of the Whale Building office building in Sunset Park to Capstone Equities.

“I think when we look back a few years from now, the up and down is going to look more smooth than what we’re feeling quarter to quarter now,” Marks said.

Abigail Nehring can be reached at anehring@commercialobserver.com.