PGIM Provides $43M for Inland Empire Warehouse

The loan will finance the development of a 373,368-square-foot distribution center

By Greg Cornfield October 23, 2023 4:45 pm

reprints

PGIM Real Estate is again raising its bet on Southern California.

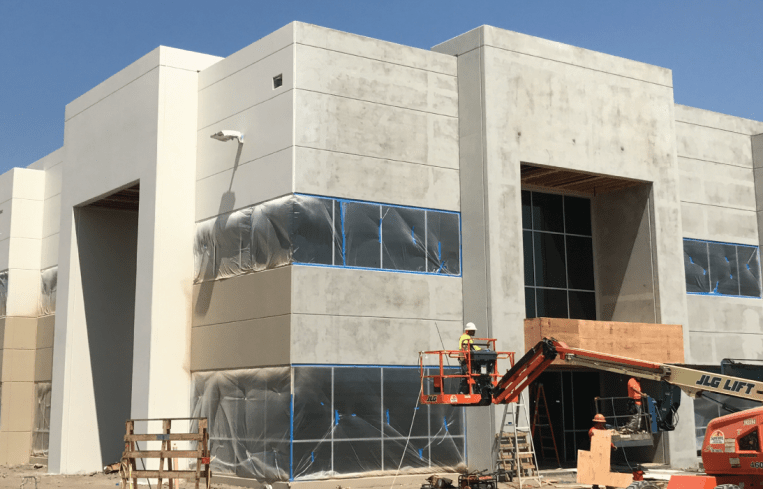

Majestic Realty has secured $43.2 million in financing from PGIM for a 373,368-square-foot “distribution-intensive” industrial development in the Inland Empire, according to data provided by Vizzda.

The project soon to be completed will be Building 11 in the larger 22-building Majestic Freeway Business Center. Neither the lender nor the borrower returned requests for comment.

Building 11 is rising on more than 18 acres of vacant industrial-zoned land at the northeast corner of Harvill Avenue and Perry Street in Perris, Calif., along Interstate 215. It’s just north of a massive warehouse for Living Spaces, and across the highway from an Amazon center, and it will include 77 trailer parking stalls and 251 surface parking spaces.

Nationally, a slowdown in industrial deliveries is on the horizon due to the rise in interest rates slowing the pace of construction financing. Approximately 204.3 million square feet of industrial space have broken ground so far in 2023, down from 614.1 million last year and 586 million in 2021, according to CommercialEdge’s most recent market report. There’s 31.8 million square feet of space under construction in the Inland Empire, the third most in the country.

PGIM’s sustained interest in Southern California has driven a significant amount of recent activity. In the past two months, Commercial Observer reported PGIM provided $84.2 million in acquisition financing for a fully leased industrial center in the San Gabriel Valley, and also provided $455 million to refinance an eight-building industrial portfolio across the region, among other investments.

Majestic Realty, based in City of Industry, said it manages 87 million square feet of space including industrial, office and retail space, as well as sports, entertainment and hospitality projects.

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.

Correction: A previous version of this article incorrectly stated the financing was a construction loan.