ESG Debate Reaches Biden’s Desk

By Chava Gourarie March 2, 2023 2:32 pm

reprints

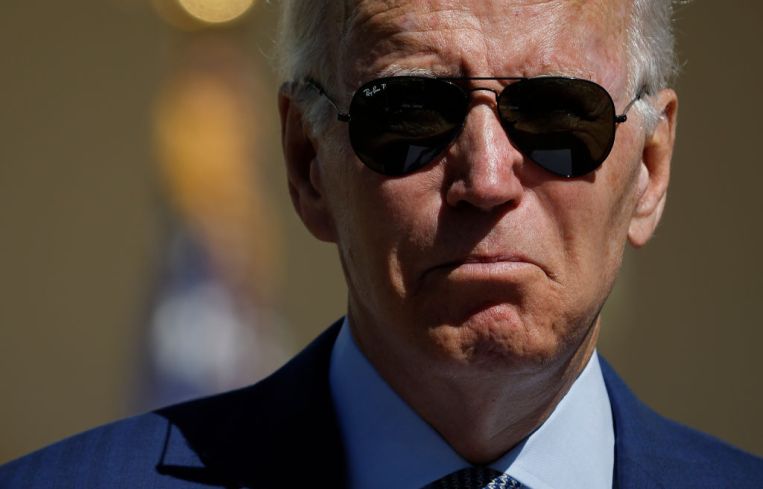

The first veto of Joe Biden’s presidency is likely to be an endorsement of environmental, social and corporate governance (ESG) investment, a financial framework that purports to incorporate societal concerns into fiduciary decisions.

The U.S. Senate, by a 50-46 vote of all Republicans and two Democrats, passed a bill Wednesday to overturn a rule put in place by the Biden administration’s U.S. Department of Labor in November allowing retirement plans to consider ESG in their investment decisions. The Labor Department resolution was a rollback of a Trump-era rule that did the opposite.

This particular scuffle is part of a much wider regulatory battle that splits predictably along partisan lines. ESG opponents claim it is an ideological agenda that distracts from profits, while proponents say it’s a financial consideration just like any other.

Currently 26 states are considering or have passed legislation that would limit considering ESG in investment decisions, mostly by requiring government-regulated vehicles to consider only financial, rather than ethical, considerations, according to an analysis by law firm Morgan Lewis. On the other hand, legislation supporting ESG has been enacted or is pending in 10 states.

Florida Gov. Ron DeSantis was one of the first to make anti-ESG legislation a rallying cry, passing a bill prohibiting ESG considerations in state pension plans in 2022, and introducing a package of laws last month that would block ESG considerations on the state and local levels in regard to investments, contracting and issuing municipal bonds. Florida, along with other Republican-led states, have also divested from companies that consider ESG in investment decisions, or that are deemed “hostile” to the fossil fuel industry.

The Labor Department rule would however pre-empt state-level laws, as it applies to any retirement funds regulated by the Employee Retirement Income Security Act (ERISA). Asset managers State Street and BlackRock, the latter of which has been the target of several Republican states, support the rule because it allows them to offer “green” financial products to their investors, according to Bloomberg.

The U.S. House of Representatives, where Republicans hold the majority, passed a similar bill Tuesday. The Senate’s approval puts the final decision in the hands of President Biden, who is expected to veto the legislation.

Regardless of Biden’s decision, the ESG rule is also facing two lawsuits, one from a coalition of attorneys general from 25 states that claim it is an administrative overreach, and another from two retirement fund participants.

Chava Gourarie can be reached at cgourarie@commercialobserver.com.