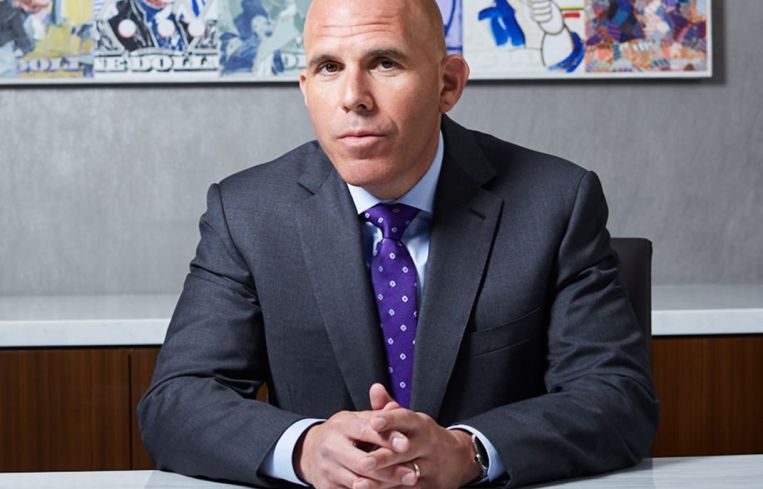

RXR’s Scott Rechler Addresses Recent Headlines in Investor Letter Obtained by CO

The RXR chairman and CEO tells investors, “We won’t throw good money after bad.”

By Cathy Cunningham February 3, 2023 2:14 pm

reprints

RXR Chairman and CEO Scott Rechler sent a note to the company’s investors Friday morning, clarifying RXR’s plans for two office properties in its portfolio.

The note, obtained by Commercial Observer, addresses a Financial Times article published Thursday, titled “New York property tycoon to give worn-out offices ‘back to the bank.’”

In the letter, Rechler called the FT’s headline “sensationalistic.”

Rechler confirmed the letter when reached for comment Friday, and told CO: “We undertook an assessment of our office portfolio in light of changing market dynamics and identified two office buildings that we consider to be challenged for the long term. We are working with our lenders on the potential conversion of these two assets, but we won’t throw good money after bad.”

Rechler went on to say that, despite various reports, only two office properties are being discussed with their respective lenders, out of the firm’s 91-property, 30.4 million-square-foot portfolio.

In the investor letter, Rechler described an “existential change” in the office sector and laid out plans for the two properties in question. He said the company is taking an “eyes wide open” approach to current market conditions and “recalibrating for the current reality.”

That recalibration involves a recent assessment of its office portfolio, via what RXR calls “Project Kodak” — an approach he outlined in an interview with CO last October. The assessment aims to determine which buildings can be considered “digital” assets — Class A and competitive — in the post-pandemic world versus which are now considered “film”— noncompetitive, obsolete and in need of disposition or conversion.

With that in mind, RXR pinpointed two office buildings that the company deemed “meaningfully challenged,” per the letter, and is currently in the process of working on resolutions for those assets.

The first, referred to simply as a “building in Brooklyn” in the letter, RXR considers to be a “good candidate for conversion into a mixed-use property that includes multi-family rentals, self-storage, retail and office,” Rechler wrote. As such, RXR is currently working with its lenders to push through a conversion plan for the building.

Rechler declined to identify the Brooklyn property on Friday, but its office building at 47 Hall Street — near the Brooklyn Navy Yard — has experienced high vacancy rates.

The second building mentioned, a Lower Manhattan building also not identified, would require a $100 million investment to re-lease it, Rechler wrote, adding that RXR doesn’t think it would be prudent to make that investment “based on the building’s current capital structure and market positioning.” The alternative plan for that particular building — which Crain’s New York Business reported is 61 Broadway — is to convert it to a multifamily building, which would also require a hefty investment.

Regardless of whether the property is re-leased or converted, 61 Broadway’s lenders will have to be fully onboard with those plans in order to execute a “meaningful restructuring,” of its existing loan, Rechler wrote.

Those discussions are currently underway and — if no agreement is reached—the last-case scenario would be to give the lenders control of the Manhattan building, Rechler wrote and confirmed to CO today.

If the keys were to be handed back on 61 Broadway, Rechler told investors in his letter that RXR already recouped most of its equity in the building, having sold a 49 percent stake in the asset in 2014 to China Orient Asset Management

In the letter, Rechler likens the bifurcation in the office market to that of the mall sector in the rise of ecommerce. He also noted that it’s not the first time RXR has made changes in its portfolio, having pivoted towards more diversified holdings — including multifamily, logistics and self-storage — back in 2016 when office valuations were inflated.

He also outlined other places the company is finding opportunity as a result of market dislocation today, including its $261 million pref equity investment in an Upper East Side portfolio late last year, which is receiving “equity-like returns,” Rechler wrote, adding that, “We believe that there will be many more of these opportunities in 2023.”

Cathy Cunningham can be reached at ccunningham@commercialobserver.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)