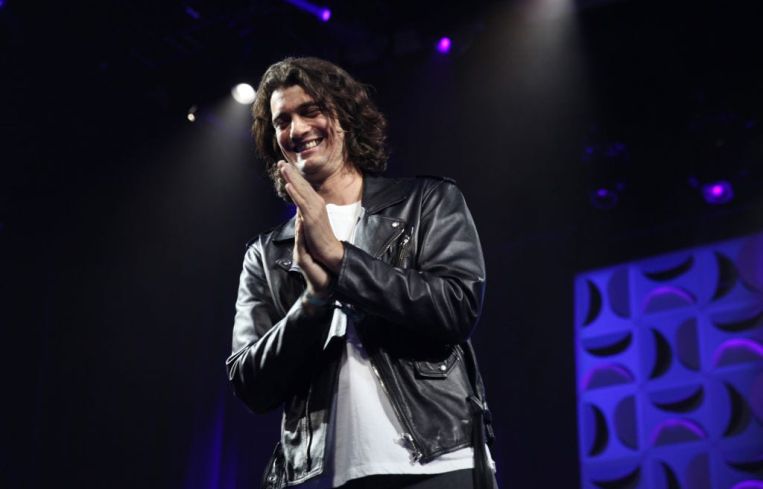

Andreessen Horowitz’s Stake in Adam Neumann’s Real Estate Confirmed

By Chava Gourarie September 13, 2022 1:41 pm

reprints

Venture capital firm Andreessen Horowitz investment in Adam Neumann’s real estate firm Flow includes a stake in the ex-WeWork CEO’s real estate portfolio.

The $350 million investment, the biggest ever for the venerable firm, had raised some eyebrows, given Neumann’s less-than-stellar history in the real estate business, as well as the fact that Flow doesn’t yet exist, and is essentially nothing more than a rental firm with highfalutin branding.

But the investment is not a regular venture check. Andreessen Horowitz (also known as a16z) has also acquired a stake in the real estate portfolio Neumann amassed over the last two years, which is reportedly worth roughly $1 billion, the Wall Street Journal confirmed.

Neumann’s portfolio consists of about 4,000 apartments across the Sun Belt, including in prime pandemic-destination cities like Miami and Fort Lauderdale. The real estate is owned by Flow, which both Neumann and a16z now have stakes in.

The move not only offers Andreessen Horowitz a degree of protection should Flow fail, it’s also a clear indication that Neumann can’t pull the same hat trick he did with WeWork: There’s no doubt that Flow is a real estate company, and a pretty standard one.

The company plans to brand its apartments and offer a community setting with common spaces and social activities — similar to the short-lived WeLive and not too far from most luxury apartments these days, which come with a raft of amenities.

Flow is expected to launch in 2023, and Marc Andreessen will join its board once it does.

Chava Gourarie can be reached at cgourarie@commercialobserver.com.