Sitex Group Snaps Up Greenpoint Industrial Site for $30M

By Cathy Cunningham January 21, 2022 10:00 am

reprints

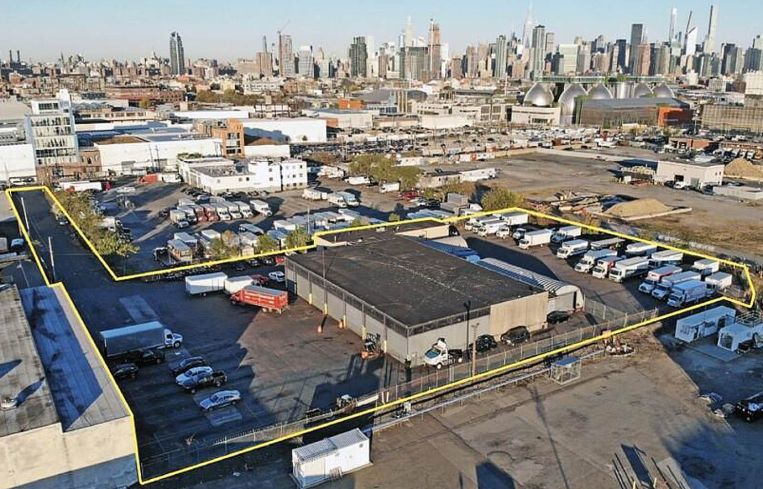

Sitex Group has expanded its Brooklyn industrial footprint by adding a 98,000-square-foot property in Greenpoint to its portfolio, Commercial Observer has learned.

The New Jersey-based investor paid $30 million for the asset at 360 Kingsland Avenue in an off-market transaction negotiated by TerraCRG partners Dan Marks and Daniel Lebor.

The deal closed on Jan. 14.

The seller was 360 Kingsland Ave Realty LLC, a family-owned firm in the fuel transportation business that had owned the site since 2012, per city property records. Sitex’s plans for the M3-1-zoned site — which includes both manufacturing and office space and has the potential for 196,000 buildable square feet — couldn’t immediately be gleaned.

“TerraCRG is thrilled to broker the sale of another significant industrial site in Brooklyn,” Marks said. “This sale is yet another sign that the industrial market remains the most-sought-after and active asset class in New York City. We are excited to see what Sitex will do with this site and are happy for the seller, who operated their business on the property for over a decade.”

The Kingsland Avenue property sits in close proximity to the Brooklyn-Queens Expressway, giving future tenants easy access to other parts of Brooklyn as well as Queens and Manhattan. Greenpoint has become an extremely desirable location for buyers of industrial product for this very reason. Marks said, “There’s a real flurry of activity in this pocket, because the connectivity is just so good.”

Indeed, CenterPoint Properties acquired the adjoining property at 301 Norman Avenue for $38 million only last month, per New York Business Journal. The transaction marked the Chicago-based firm’s third warehouse purchase in 2021.

The industrial sector continues its reign in New York City, Marks said, with no shortage of buyers in the supply-constrained market — where few areas are fit for industrial use.

As the momentum behind the sector has skyrocketed, the institutional quality of buyers channeling their interest — and dollars — toward industrial properties has also improved, with major investors aggressively pursuing acquisition opportunities in the outer boroughs.

Industrial sites that top 100,000 square feet are especially rare and — understandably — snapped up in a New York minute.

And, another major draw for buyers of industrial properties today is the inclusion of unimproved land in their purchase — something that the Kingsland Avenue property has plenty of.

Focused on acquiring and repositioning industrial assets in major infill assets across the U.S., Sitex caught the industrial wave just as it was starting to form in Brooklyn. It made its first big splash in Red Hook in 2017, when it purchased a six-property, 1.2 million-square-foot industrial portfolio from Italian developer Est4te Four. Sitex paid $105 million for the waterfront assets, selling them to then-tenant UPS in December 2018, only 20 months later for $303 million.

In November 2021, Sitex paid $50 million for a 3.37-acre site at 58-80 Borden Avenue in Maspeth, Queens, as reported by The Real Deal, and three months earlier it acquired a 40,000-square-foot building on six acres of land in Paramus, N.J., executing a sale-leaseback deal with transportation behemoth Coach USA.

The seller of the Kingsland Avenue property chose not to go through a formal bidding process when it decided to sell, and Sitex was a patient buyer which allowed the company both time and flexibility to exit the property when the circumstances were right for it to move to a new location, Marks said.

Sitex officials declined to comment.

Cathy Cunningham can be reached at ccunningham@commercialobserver.com